Market picture

Crypto market capitalisation is almost the same level as a week ago – near 1.045 trillion. The Bitcoin pump and dump tickled the market with nerves, formally tied to events surrounding Grayscale’s Bitcoin ETF fund.

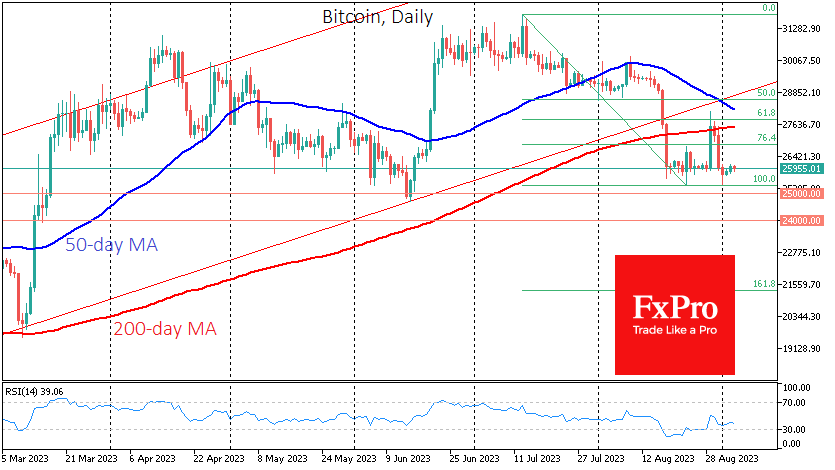

Bitcoin has been pegged at $26K for more than two weeks. An attempt to move back above the 200-day average has technically encountered stronger selling, confirming that the bears are not relinquishing market control. This disposition suggests higher risks that the consolidation will end with downside momentum, potentially at $25K or even $24K.

On Ethereum’s daily timeframes, a “death cross” has formed, with the 50-day moving average falling below the 200-day MA. Such a signal suggests a further decline, emphasising the bearish trend here. On the Bitcoin chart, such a pattern could form next week. But we also note that ETH already looks locally oversold.

Toncoin (TON) rose 26% over the week, taking the top spot for growth in the top 100 cryptocurrencies. The token soared to 11th place in CoinMarketCap’s capitalisation ranking. In August, the number of registered addresses in the project’s network exceeded 3.2 million.

News background

Throughout August, there was a slight but steady deviation of the USDT exchange rate from the US dollar, which is “a cause for concern,” Kaiko notes. Meanwhile, quotes from USDT’s competitors remained generally more stable.

Investment company Bitwise withdrew its application to launch an ETF based on a basket of bitcoin and Ethereum following the SEC’s decision to postpone its review of applications to launch spot bitcoin ETFs.

Former SEC head Jay Clayton said it was inevitable that the regulator would approve a spot bitcoin-ETF. He said the dichotomy between futures and spot products cannot continue forever.

A court in China has recognised cryptocurrency as legally protected property despite a ban on trading crypto assets in the country since 2017. Meanwhile, according to The Wall Street Journal, China accounts for a fifth of Binance’s trading volume.

According to a report by crypto exchange KuCoin, 52% of Turkish residents aged 18 to 60 are investing in cryptocurrencies amid high inflation in the country. The figure has grown by 12% over the past 1.5 years.

The FxPro Analyst Team