Market picture

The cryptocurrency market shed a further 0.7% of its capitalisation in 24 hours to $2.26 trillion, coinciding with a strengthening of the dollar and a short-term fixation in gold as markets reacted to Powell’s hints that the Fed would prefer 25-point rather than 50-point cuts. The confident momentum in equity indices suggests that the overall bullish sentiment has been maintained.

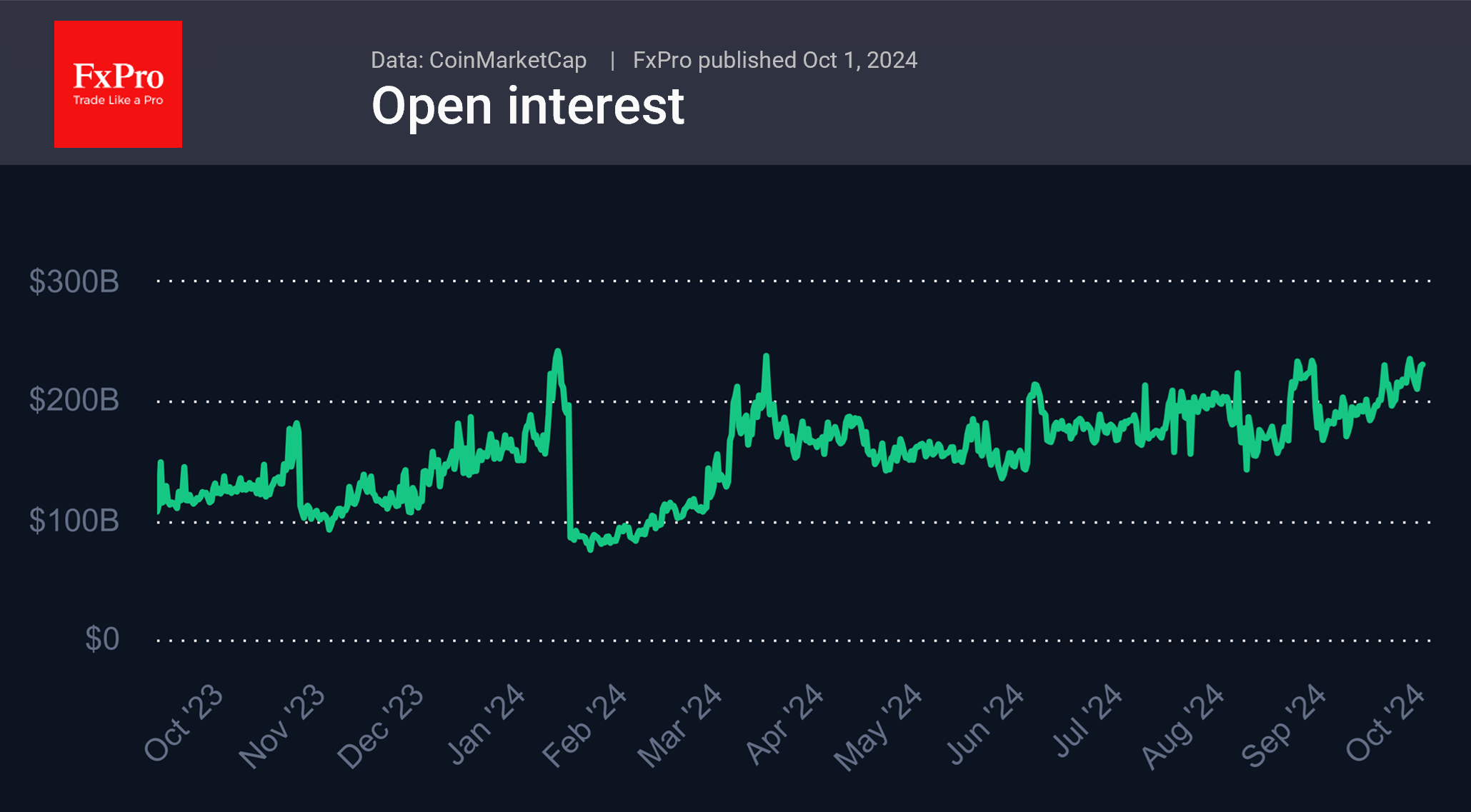

Open interest in crypto derivatives also points to this. The index has been rising steadily since the beginning of September, reaching 230 billion, close to this year’s highs. Over the past three weeks, the rise in the indicator has coincided with price gains, suggesting an influx of fresh money from buyers. However, near this level of open interest in January, March, May, and late August, the price formed a local spike, increasing nervousness in the coming days.

According to CoinShares, investment in crypto funds rose by $1.228 billion last week, the third consecutive week of net inflows. Bitcoin investments increased by $1.07 billion, Ethereum investments increased by $87 million, and Solana investments decreased by $5 million. Investments in multi-asset crypto funds increased by $65 million.

Bitcoin ended September up (+8.2%) at $63,800. BTC recovered almost all of August’s decline, defying seasonal trends for the worst month of the year. October is one of the three best months of the year. Over the past 13 years, Bitcoin has ended the month with a gain nine times. The average gain was 29.3%, and the average decline was 15.3%.

News background

10x Research believes that the current pullback in the first cryptocurrency is a typical correction due to its overbought nature. Since June, BTC has always corrected lower in the first week of the month.

According to DecenTrader, if BTC holds a key support level of around $63K, the first cryptocurrency has a chance to start a bullish rally. Bitcoin’s long-to-short ratio is now at an extremely low level, which has always preceded the asset’s growth.

Michaël van de Poppe, founder of MN Trading, believes that the current market situation for Bitcoin is as favourable as it can be due to the weakening US labour market and growing distrust in traditional financial institutions. According to his forecast, BTC will rise to $192K by the end of the year and $600K next year.

FalconX predicts that by mid-2025, the Fed’s benchmark interest rate will be below the return on Ethereum, driving up the price of the second most-capitalised cryptocurrency.

The Dutch Financial Markets Authority (AFM) has warned of the risks of investing in cryptocurrencies, expressing fears that users could fall victim to market manipulation and lose investments in pump-and-dump schemes.

The FxPro Analyst Team