Market Overview

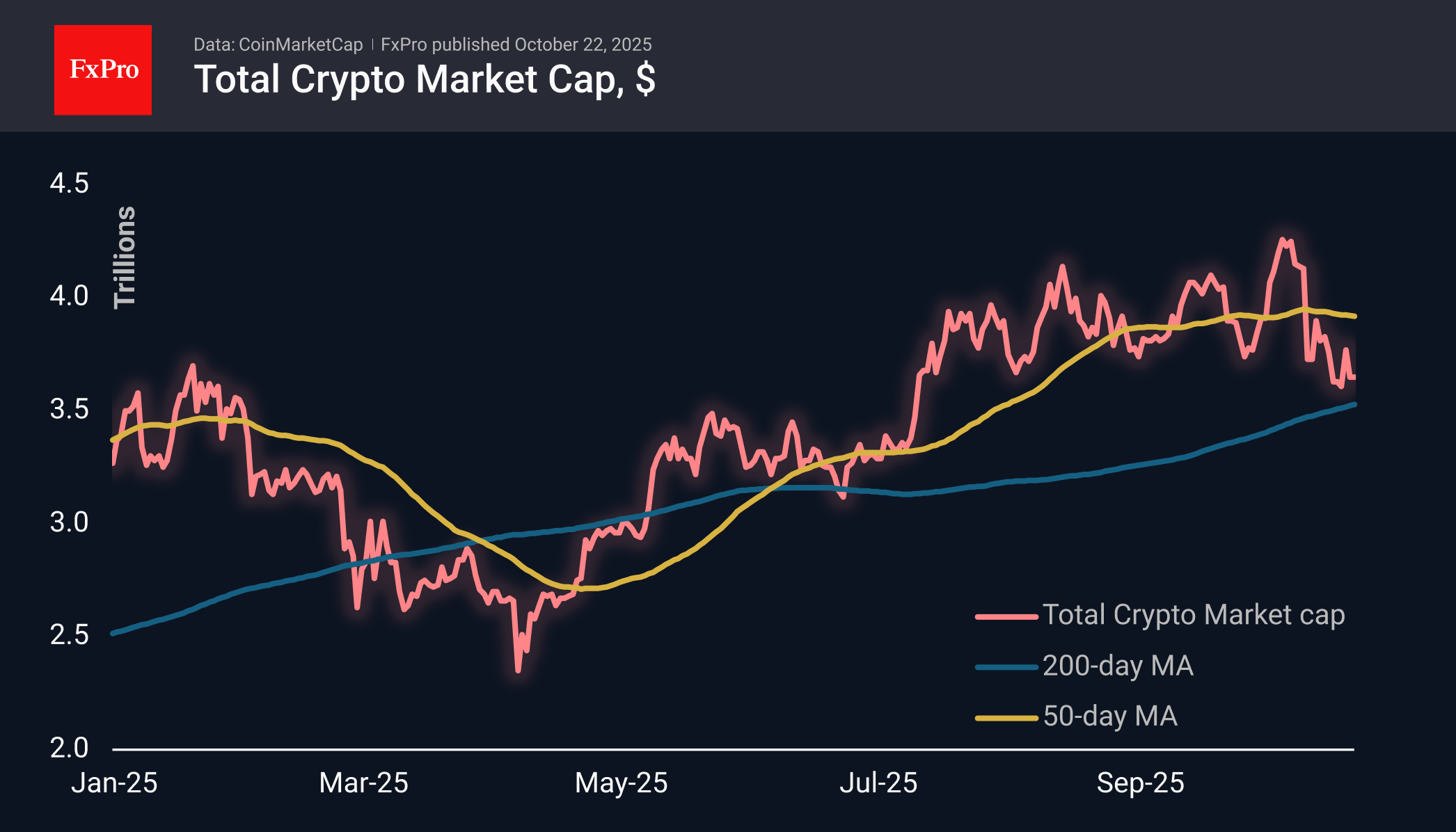

The crypto market cap changed slightly over the past day, remaining at $3.65 trillion, completing a full circle with a 5% increase and a return. Relatively small coins such as Zcash (+6.6%), Dash (+3%) and Tezos (+2.7%) performed slightly better than the market, remaining unaffected by the fluctuations in risk appetite among large institutions selling top coins on the rise.

Such fluctuations do not contribute to improving the mood of crypto investors. On the contrary, the corresponding index fell to 25, on the verge of extreme fear territory. At current levels, the rule of ‘buy when everyone is afraid’ may work, or there may be a switch to a more intense sell-off after three months of stagnation.

Bitcoin rose to $114K on Tuesday, touching the 50-day moving average, but this only fuelled sellers. Bitcoin has been balancing the 50- and 200-day MA for the last eleven days. The latter curve is pointing upwards, reducing the space for free fluctuations and bringing the moment when the market will have to choose a direction closer.

News Background

Bitcoin’s bullish phase is not over yet, according to the creator of the S2F model and analyst Plan B. The fundamentals point to continued growth, and there are no key technical signals indicating a final bull market phase.

According to BTSE COO Jeff May, market volatility will continue. TD Cowen remains positive about BTC and forecasts the asset to grow to $141,000 by December.

Analyst Willy Woo believes that the next bear market in the crypto cycle will differ from previous ones. It could be triggered by economic crises, such as those in 2001 and 2008, which the crypto market has not yet experienced.

Polygon co-founder Sandip Nailwal criticised the Ethereum network’s leadership and emphasised that its community has ‘turned into a circus.’ The success of projects on the ETH network depends on a few venture capital funds and proximity to a small circle of people around Vitalik Buterin, said Geth client developer Peter Szilagyi.

According to Lookonchain, Elon Musk’s company SpaceX has moved $257 million worth of Bitcoin for the first time since July. The company did not comment on the reasons for the transfers. According to Arkham, SpaceX owns 5,790 BTC.

The FxPro Analyst Team