Market picture

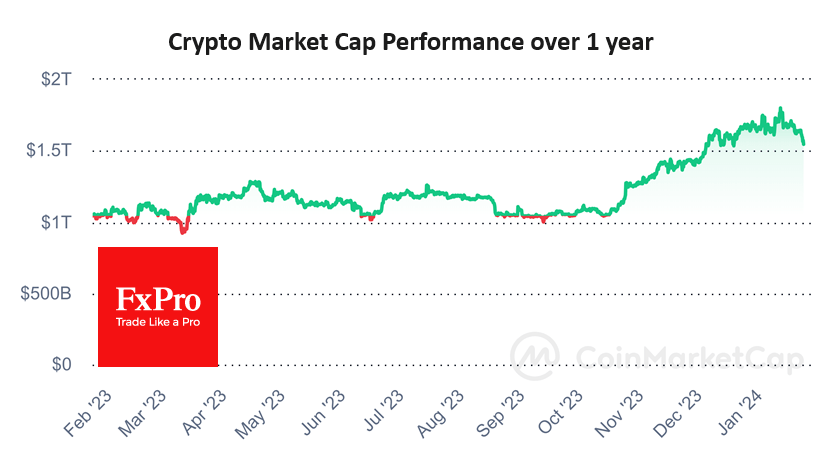

The crypto market lost over 5% in 24 hours, to $1.52 trillion. Bitcoin has remained under pressure since the start of the week after pausing in the sell-off on Saturday and Sunday. The persistence of the sell-off has triggered a sell-off in many altcoins, losing with greater amplitude than BTC.

The very nature of the Bitcoin sell-off makes one look for an institutional trail, as it occurs predominantly during the most active trading hours of US exchanges. Whether this is due to capital flows due to the launch of spot ETFs or a shift in investor interest from the crypto market to equities is entirely possible.

Having fallen below $39k, the Bitcoin price now risks going beyond the typical correction after the rally that started in September. Up to the $37.5K area, Bitcoin may encounter little support. But below that lies an area of prolonged consolidation, where the chances of another long tug-of-war are high. A step down from these levels will make one seriously consider a bearish outlook for cryptocurrencies for the next few weeks or months.

News background

Most investors who liquidate positions in Grayscale’s GBTC will channel funds into other bitcoin-ETFs, which will neutralise the current BTC weakness, Galaxy Digital CEO Mike Novogratz said. Earlier, a number of experts attributed the current bitcoin decline to liquidations of positions in Grayscale’s GBTC ETF fund.

According to CoinShares, investments in crypto funds fell by $21 million last week after record inflows since 2021; outflows were recorded after four weeks of growth. Investments in Bitcoin fell by $25 million, Ethereum by $14 million, and Solana by $8.5 million, while investments in funds that allow Bitcoin shorts rose by $13 million.

Crypto fund outflows last week were negligible, although the numbers mask very high trading volumes ($11.8bn), which is seven times the average weekly trading volume in 2023—existing ETFs with higher costs suffered in the US. Outflows from Grayscale’s GBTC fund totalled $2.23bn and could not be offset by investments in other ETFs, CoinShares noted.

Bitcoin will fall below $40K due to deteriorating liquidity in the financial system. The decline will continue until 31 January – the announcement of the US Treasury’s quarterly borrowing plan expects ex-CEO of BitMEX Arthur Hayes. To implement the strategy, he bought March put options with a strike price of $35K.

Kiarash Hossainpour, founder of Colorways Ventures and The Consensus, said Bitcoin is expected to come under heavy pressure in the first half of the year due to a likely sell-off from former and current large BTC holders such as GBTC, Mt.Gox, Celsius and FTX.

According to platform Crypto.com, the total number of cryptocurrency users grew 34 per cent from 432 million to 580 million at the end of 2023, with Bitcoin and Ethereum leading the way in terms of increased adoption. The number of BTC owners grew by 33% (from 222 million to 296 million) and ETH – by 39% (from 89 million to 124 million).

The FxPro Analyst Team