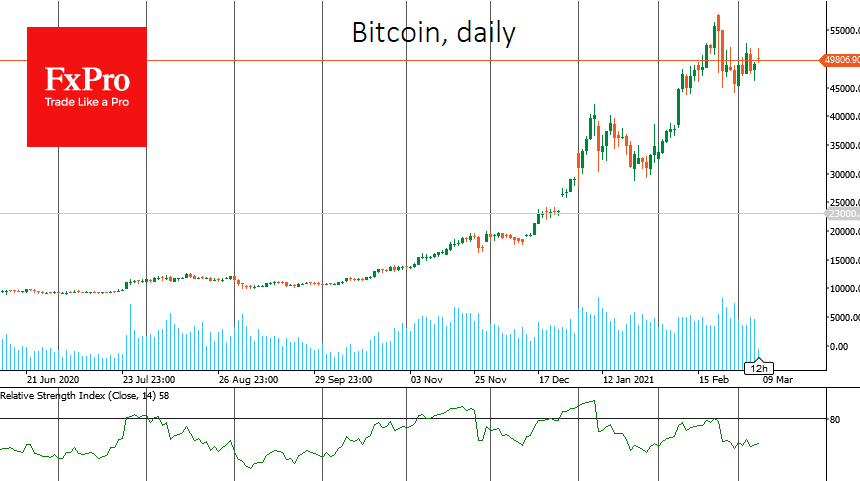

Bitcoin has added 2.5% over the past 24 hours and is trading near $51K. The bulls and bears have been playing tug-of-war over the past week. Bitcoin is up nearly 10% for the week, which also speaks to an optimistic approach to the crypto market’s short-term prospects. The capitalization of the first cryptocurrency is heading towards $1 trillion. It is worth remembering that even in the recent past, market participants were looking forward to the moment when the capitalization of all digital currencies would reach the cherished $1 trillion level.

The Crypto Fear & Greed Index for Bitcoin and major cryptocurrencies rose by 5 points to “81” in the “extreme greed” territory. Previously, for several months, this did not prevent Bitcoin from making new highs, and it seems that the situation is not much different now. Judging by the recent price dynamics, most holders of the benchmark digital asset are still waiting for growth to continue. Market participants agree that the current stage may still correspond to September 2017, when Bitcoin corrected before the final surge.

Bitcoin’s positive momentum has also supported the entire altcoin market. The leading alternative cryptocurrency, Ethereum (ETH), is up 5% overnight and trades around $1,750. Over the week, ETH jumped an impressive 22%. Thus, we saw that there is unrealized buying potential in the market. Even more positive is that “bargain hunters” found the price level of about $1,300 acceptable for buying the asset.

Other altcoins show less impressive positive dynamics. Nevertheless, the market as a whole is in the green zone, contrasting sharply with what was happening last March, when markets saw panic selling due to fears around a new virus. It is this missed moment that investors are now regretting the most, as March 2020 was the last chance to buy Bitcoin and other coins at incredibly low prices compared to current levels.

DeFi token Uniswap (UNI) also shows rapid positive momentum, reflecting the overall success of decentralized financial applications. The coin is currently in the top 10 cryptocurrencies, ranking 8th with a capitalization of $17 billion. The DeFi sector has a total of $39 billion in blocked tokens. In the long term, this market is showing steady growth. In just one year, the DeFi market has grown by more than 4,000%. Such decentralized financial applications will likely become crucial parts of the crypto market on the back of the constant tightening of regulators’ control.

The FxPro Analyst Team