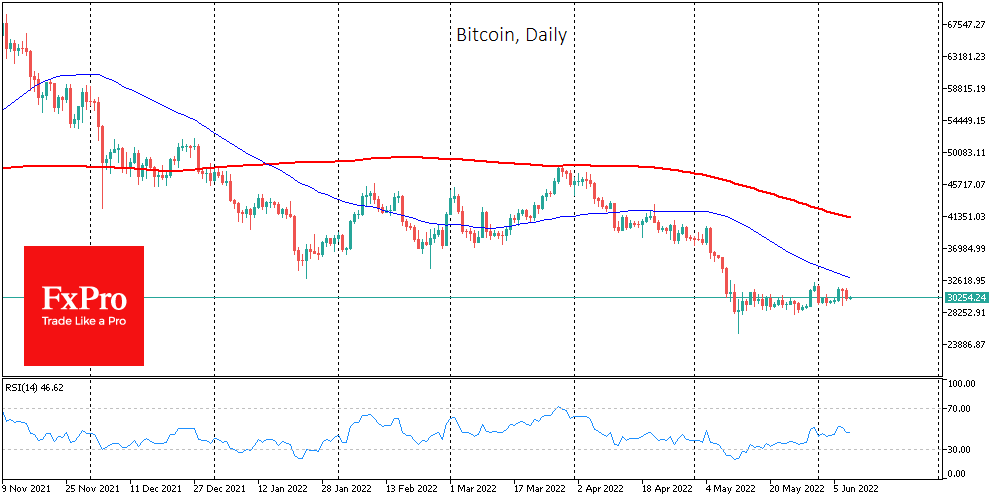

Bitcoin was down 3.7% on Wednesday, ending the day near the $30.2K level, which it remains near on Thursday morning. The overall subdued sentiment towards cryptocurrencies coincided with a pullback in stock indices. However, the dynamics of the previous days suggest that this is more of a coincidence than a correlation.

Cryptocurrencies have entered a period of the most pronounced and prolonged lull since late 2020, as the total cryptocurrency cap hovers between $1.2 and $1.3 trillion for almost a month. This lull is also reducing trading volumes, as the entire cryptocurrency industry often attracts the attention of lovers of solid moves.

In the past 24 hours, Ethereum has lost 0.5%, hovering around $1800 at writing. Altcoins from the top 10 show small multidirectional movements from a 0.75% decline (BNB, Solana) to a 0.7% rise (Polkadot).

The cryptocurrency fear and greed index were down 6 points to 11 by Thursday and remains in “extreme fear”.

The nature of the cryptocurrency market, built on hype, convinces us that a lack of movement is the worst news for cryptocurrencies. Perhaps only strong moves can attract interest. Crypto traders anxiously recall the “crypto winter” of 2018. However, a crypto summer lull that started a month ago may not be any easier. It’s a worrying lull that risks quickly turning into a selloff. We still believe that the bear market for Bitcoin and the entire cryptocurrency market has yet to play its final act, and that should be expected before the end of the year.

MicroStrategy CEO Michael Saylor believes bitcoin will never fall to zero as international regulators look for ways to control crypto assets rather than impose a total ban on them.

Anne Boden, CEO of UK bank Starling, said cryptocurrencies are too often linked to fraud and money laundering, making them a threat to traditional payment systems.

PayPal said it would allow its customers to transfer BTC, ETH, BCH and LTC to external addresses, including exchanges and hardware wallets. Mining company Marathon Digital said that bitcoin miners do not incur losses even in a falling market, as the cost to mine 1 BTC is about $6,250.

The FxPro Analyst Team