Market Picture

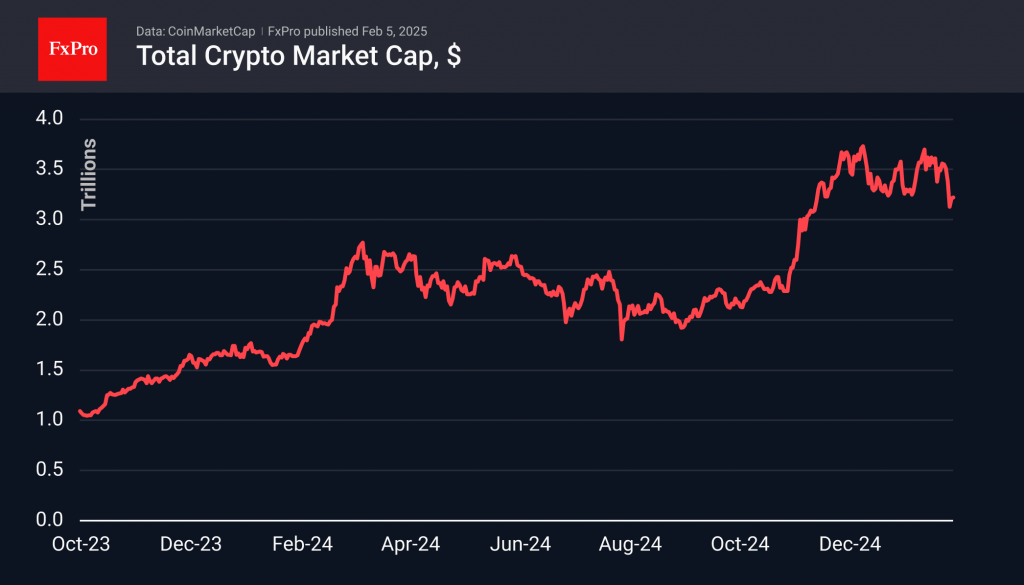

The cryptocurrency market remains in the same position as the previous day, with minor changes at the end of the 24 hours and a capitalisation of $3.21 trillion. Increased buying volumes met market dips, but a new info catalyst is needed for real growth.

The Altcoin Season Index fell to 36, indicating that the first cryptocurrency was the driver of growth. The crypto market sentiment index lost 18 points to 54 (Neutral). Sentiment volatility does not necessarily mean that a reversal is imminent, but it does delay the start of a full-fledged rally. The corrective pause continues.

Bitcoin is trading around the 97,500 level and continues to oscillate around its 50-day moving average. The market seems to have found a short-term balance here. However, it is not very positive that the price is trading below the psychologically significant 100,000 level.

News Background

According to CryptoQuant, the cryptocurrency market has been ‘cleansing’ itself of excessive leverage following the drop on February 3rd. The last time there was such a large liquidation of derivatives and a sharp reversal of the rising trend in open interest was in August 2023.

On February 3rd, daily trading volume in US spot Ethereum ETFs reached a December record of $1.5 billion, of which $736 million was in BlackRock’s ETHA.

Most Ethereum validators supported increasing the network’s gas limit – the maximum amount that can be used for transactions in a single block. This improves network performance without the need for a hardfork.

As noted by CryptoQuant, the funding rate for perpetual BTC contracts has turned negative. In the last six instances, this has served as a harbinger of bullish momentum.

The FxPro Analyst Team