Market Picture

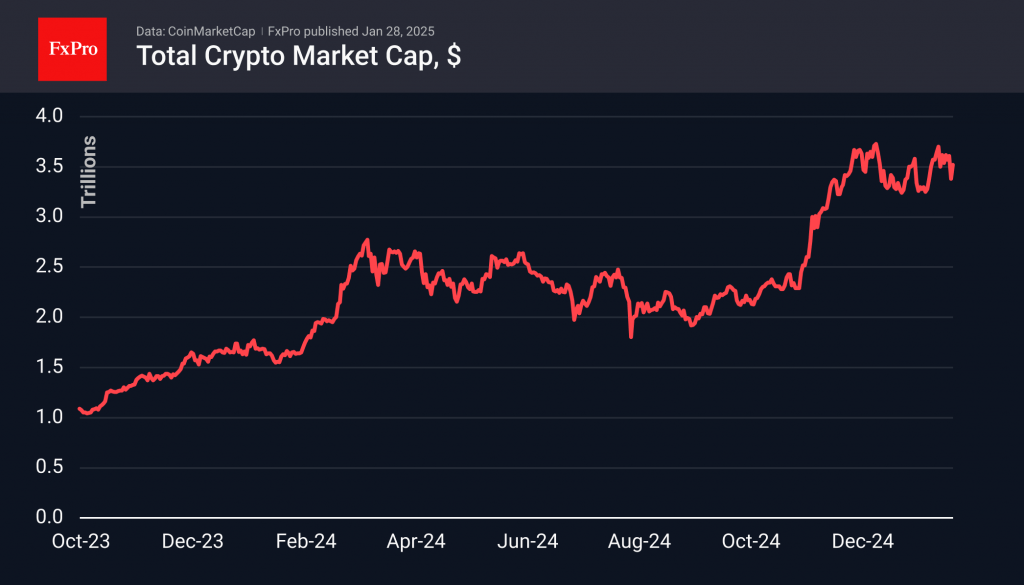

On Monday, the cryptocurrency market partially recovered from the initial decline, regaining about 2/3 of the lost value. As a result, the cryptocurrency market capitalisation increased by 4.3% from the previous day and, by the start of trading in Europe, stands at $3.52 trillion. This is still below the level of the previous weeks when capitalisation hovered around $3.6 trillion.

The cryptocurrency market sentiment index rose to 72 over the past day, showing a steady appetite for risk assets despite the recent sell-off.

By the end of Monday, bitcoin had recovered from its fall and was back above the $101K mark. On Tuesday morning, its price approached $103K, crossing the 50-day moving average.

XRP, after losing more than 15% during Monday’s day, ended trading above the important $3 level. The price is currently at $3.09, showing a full recovery from the slump and a demonstration of strength that many other altcoins lack.

News Background

After another recalculation, bitcoin’s mining difficulty fell 2.12% to 108.11T, the first decline since September 2024.

According to CoinShares data, global crypto fund investments totalled $1.858bn last week, up from $2.195bn a week earlier. This positive trend continued for the third week in a row, intensifying in the last two weeks. Bitcoin investments were up $1.591bn, Ethereum up $205m, XRP up $19m and Solana up $7m.

CoinShares suggests that the rise in investment in digital assets can be attributed to President Trump’s executive orders to create a strategic reserve asset in Bitcoin. Among smaller digital assets, Solana, Chainlink, and Polkadot received the largest investment inflows.

According to CryptoQuant data, the share of investors with a balance of at least 1,000 BTC who purchased coins in the last 155 days increased from 43% to 60%, reflecting the emergence of large players amid optimistic sentiment.

The FxPro Analyst Team