Market picture

Bitcoin is consolidating around the $30K mark for the third day, moving in a tight $20.7-30.3K range. Yesterday’s news from the US had a moderately negative impact on the price but did not cause any sustained pressure.

With the market pulling back from local highs earlier in the day, cryptocurrency capitalisation is now around 1% higher than 24 hours ago. Bitcoin added 0.5%, Ethereum 2.7%, and the top altcoins ranged from -0.2% (XRP) to +5.5% (Solana).

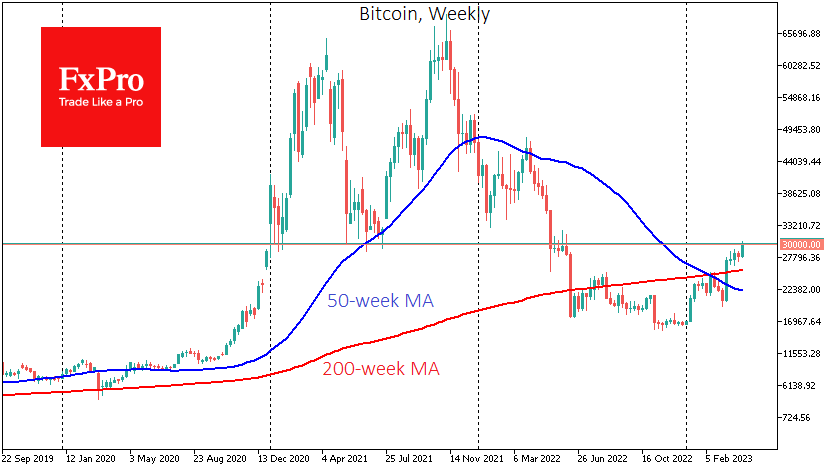

The $30,000 mark was significant for Bitcoin in 2021 and the first half of 2022, acting as a market mode switch. Last year, bitcoin consolidated around this price for about five weeks before plunging sharply. There is a greater chance of a mirror dynamic, with the bulls taking a long time to gather their strength before making a decisive move higher.

The entire cryptocurrency market could follow a similar dynamic to the flagship cryptocurrency.

Bank of America noted that there had been a substantial outflow of bitcoins from cryptocurrency exchanges to users’ wallets. This occurs when investors intend to hold BTC for the long term, suggesting that the pressure from sellers may be easing.

News background

According to Pew Research, around 70% of Americans with varying degrees of awareness of cryptocurrency projects do not plan to invest in digital assets soon. High volatility, high-profile bankruptcies and regulatory uncertainty have all played a role.

A European Commission agency has published a document calling for stricter identity checks on users of cryptocurrency exchanges and crypto ATMs.

The Spanish government’s tax agency (AEAT) has stepped up efforts to collect taxes from local holders of digital assets. Officials will notify 328,000 traders.

The Binance.US exchange announced that it was delisting trading pairs involving TRON (TRX) after rumours surfaced online that Tron founder Justin Sun had been arrested by Hong Kong law enforcement. Sun later denied the rumours.

Argentina’s National Commission of Values (CNV) approved a futures index for Bitcoin as part of its strategic innovation programme. The index would be the first such product in Latin America.

The FxPro Analyst Team