Market picture

The cryptocurrency market is up 2.7% to $1.121 trillion, approaching the middle of its trading range for the past month. Strong growth momentum late on Tuesday allowed for a brief recovery of capitalisation lost after news of SEC actions against Binance and Coinbase.

Bitcoin has risen 4% in the last 24 hours to $26.85K, finding strong support on dips below $25.5K. Such active buying is a sign that crypto enthusiasts are confident that a US regulator on the warpath will not cause global problems for cryptocurrencies.

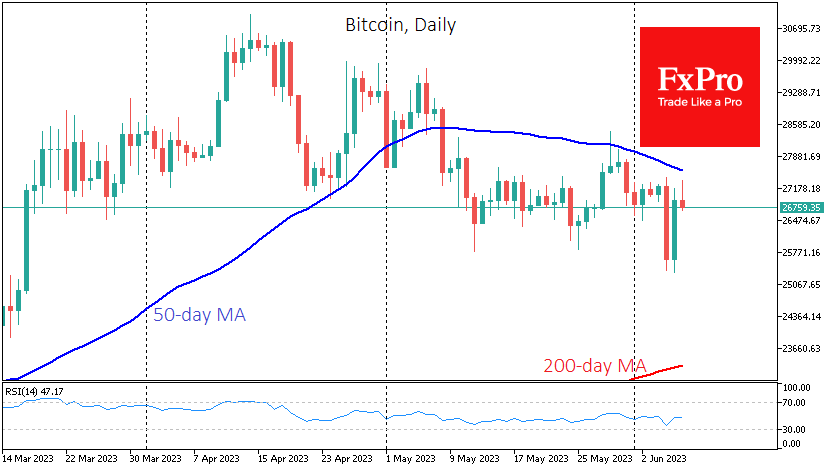

Technically, yesterday’s strong buying has somewhat lowered the temperature of concerns about the near-term outlook for the price. It was back above the 200-week average and within the closing ranges of the last four weeks. Nevertheless, a wait-and-see approach now seems more prudent as Bitcoin has yet to prove its ability to gain further strength. A significant bullish signal would be a surpass of $27.5K, where many local highs and the 50-day moving average are concentrated.

News background

Binance has issued a statement saying that it will “vigorously defend itself” in the case against the SEC. Binance has also refuted allegations that the platform puts customer funds at risk. The platform has been accused of falsifying trading volumes and trading in unregistered securities and has mentioned 61 tokens at once, including big names such as SOL, ADA, MATIC and ATOM.

In its crusade against crypto, the SEC sued Coinbase, the largest US crypto exchange. According to the agency, several tokens on the exchange fit the definition of securities: SOL, ADA, MATIC, FIL, SAND, AXS, CHZ, FLOW, ICP, NEAR, VGX, DASH and NEXO.

SEC chief Gary Gensler said on CNBC that the modern world doesn’t need cryptos.

Charles Hoskinson, Cardano founder, called on the crypto industry to unite against SEC authoritarianism to prevent totalitarian control of people’s finances. He said the regulator was “turning the US into an Orwellian dystopia” and introducing the digital dollar would give the Fed complete control over people’s finances.

The FxPro Analyst Team