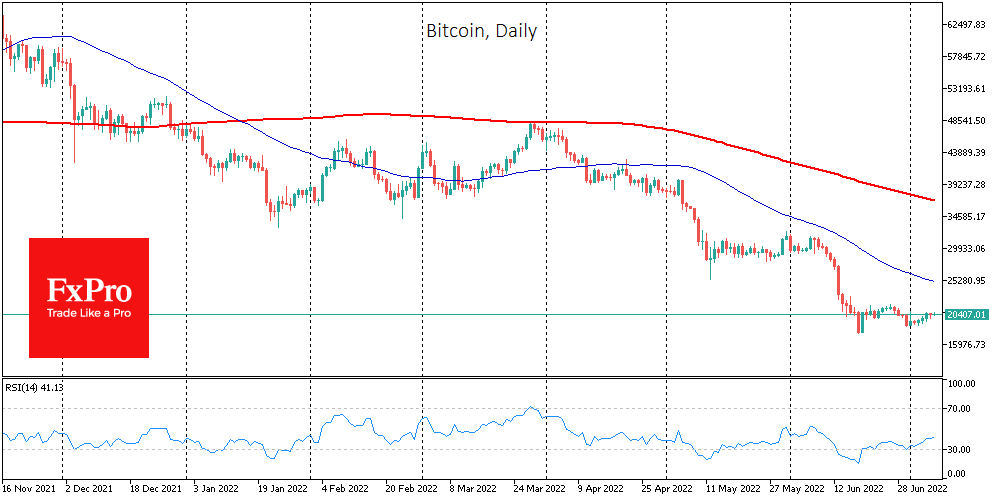

Bitcoin is up around 1% in 24 hours to $20,400. Ethereum added 3.2%, while other top 10 altcoins gained between 0.7% (Dogecoin) and 2.8% (XRP). Buyers have braced themselves on the back of positive stock indexes despite the strengthening Dollar.

Total cryptocurrency market capitalisation, according to CoinMarketCap, rose 1% overnight to $916 billion. The ‘crypto fear and greed’ index has unchanged by Thursday, remaining at 18 points (“extreme fear”).

Bitcoin rebounded from an early-day decline in the US session on Wednesday on the back of strengthening US stock indices.

Popular Twitter blogger Bluntz believes that the current technical picture on the BTC and ETH charts suggests a massive rise in the cryptocurrency market is imminent.

Market veteran Peter Brandt, who predicted crypto winter 2018, expects bitcoin to fall towards $14,000. In his opinion, a “pennant” pattern may form on the BTC chart, which implies a further decline.

The cryptocurrency market is looking more and more like the stock and oil markets, said Coinbase chief economist and one hardly should compare Bitcoin with Gold.

The US Federal Reserve has announced that the central bank’s digital currencies will not lead to radical changes to the international monetary system, so they do not threaten the status of the US dollar.

The Bank of England is concerned about the long-term impact of cryptocurrencies on the financial system and given the market “vulnerabilities” in the crypto market, has proposed stricter rules for the crypto industry.

The FxPro Analyst Team