The value of the cryptocurrency market rose almost 3% over the past 24 hours to 2.07 trillion. Exceeding the psychologically important circular mark pulled demand for coins outside the top 10.

Separately, bitcoin enjoyed demand from the pull into risky assets in traditional financial markets and the weakening dollar. Bitcoin has fallen slightly short of the entire crypto market since the beginning of the week, pushing its share down to 40%.

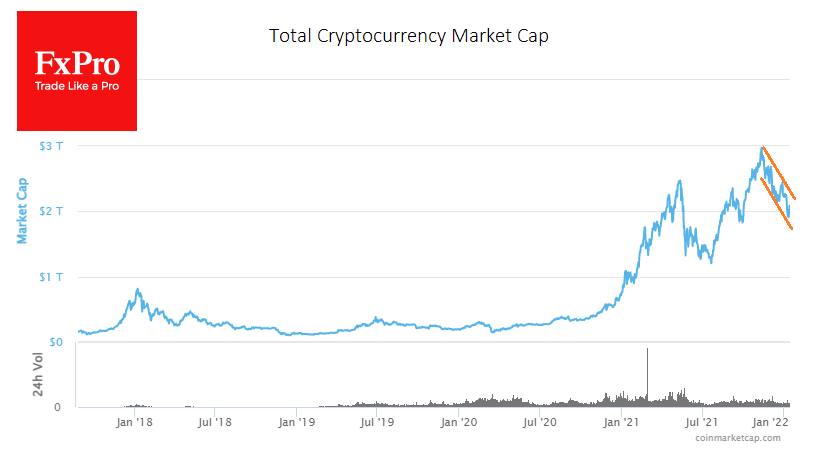

However, it is too early to say that a new rally in crypto has begun. The crypto market remains 30% below its peaks in early November, and capitalisation growth is uneven.

Interestingly, the cryptocurrency fear and greed index lost 1 point to 21 overnight, despite increasing market cap.

Yesterday’s rise did not gain traction at the start of the day on Thursday. Fixing above $45K against $43.5K now would confirm the strength of the bulls. It is reasonable to talk about a rebound within the descending channel until that time.

If the dollar goes back to growth in the nearest future, it will pressure stock markets. The cryptocurrency market, in these circumstances, risks reversing back to the downside, stopping the rebound and remaining in a prolonged downtrend channel. We should be wary of a smooth decline like this, as it drains optimists. We saw a similar descent in 2018 when the fall became uniformly smooth in the second half of the year, and a wide range of crypto-enthusiasts switched to standby mode until mid-2020.

The FxPro Analyst Team