With a sharp decline over the weekend, Bitcoin wiped out the initial weekly gains, giving bears the upper hand for the third straight week. There were drawdowns to $34K on the low-liquid market on Saturday and Sunday. So the rate of the first cryptocurrency fell to $38K with a 3.8% loss. However, over the past 24 hours, BTC has reached $39,000 while Ethereum has lost 4.5%. Other leading altcoins from the top ten decline from 2% (XRP) to 6.8% (LUNA).

According to CoinMarketCap, the total capitalization of the crypto market decreased by 3.8%, to $1.71 trillion. The bitcoin dominance index sank from 42.9% on Friday to 42.3% due to the sale of bitcoin over the weekend.

The cryptocurrency fear and greed index is at 23 now, remaining in a state of “extreme fear”. Looking back, in the middle of the week, the index had a moment in the neutral position.

The sales were triggered by reports that the BTC.com pool banned the registration of Russian users. Cryptocurrencies do not remain aloof from politics, hardly confirming the role of an alternative to the banking system now, supporting EU and US sanctions against Russia, and showing their initiative. The news appeared that Switzerland would freeze the crypto assets of the Russians who fall under the sanctions.

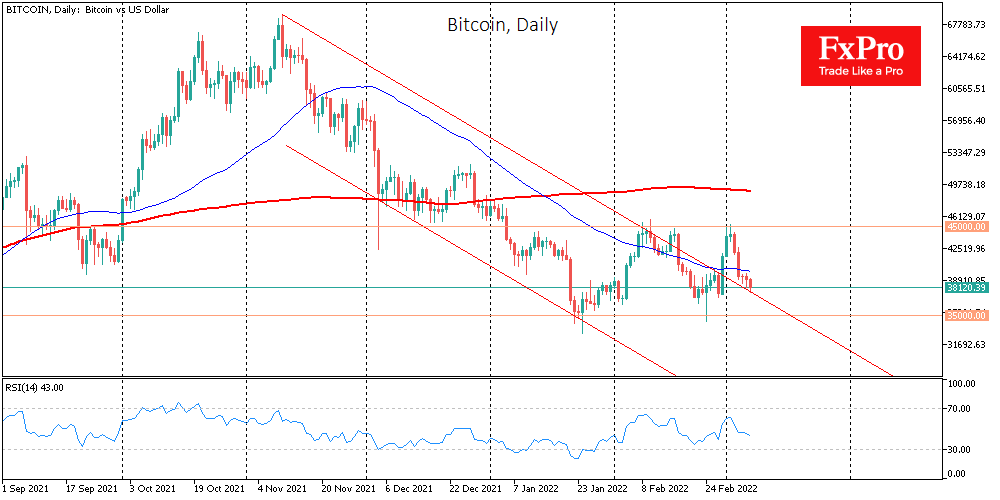

In the second half of the week, bitcoin lost almost all the growth against the backdrop of a decline in stock indices. Although last week started on a positive wave: BTC added nearly $8,000 (21%) since the previous Monday but couldn’t overcome the strong resistance of mid-February highs at around $45,000 and the 100-day moving average. Speaking about the prospects, pressure on all risky assets will continue to be exerted by the situation around Ukraine, where hostilities have been taking place for two weeks.

Worth mentioning that the world-famous investor and writer Robert Kiyosaki said that the US is “destroying the dollar” and called for investing in gold and bitcoin.

At the same time, the founder of the investment company SkyBridge Capital (Anthony Scaramucci) is confident that bitcoin will reach $100,000 by 2024. Now, he has invested about $1 billion in BTC. Plis, a group of American senators, develops a bill that opens access to the crypto market for institutional investors. And one more piece of news to consider: the city of Lugano in Switzerland has recognized bitcoin and the leading stablecoin Tether (USDT) as legal tender.

The FxPro Analyst Team