Market Overview

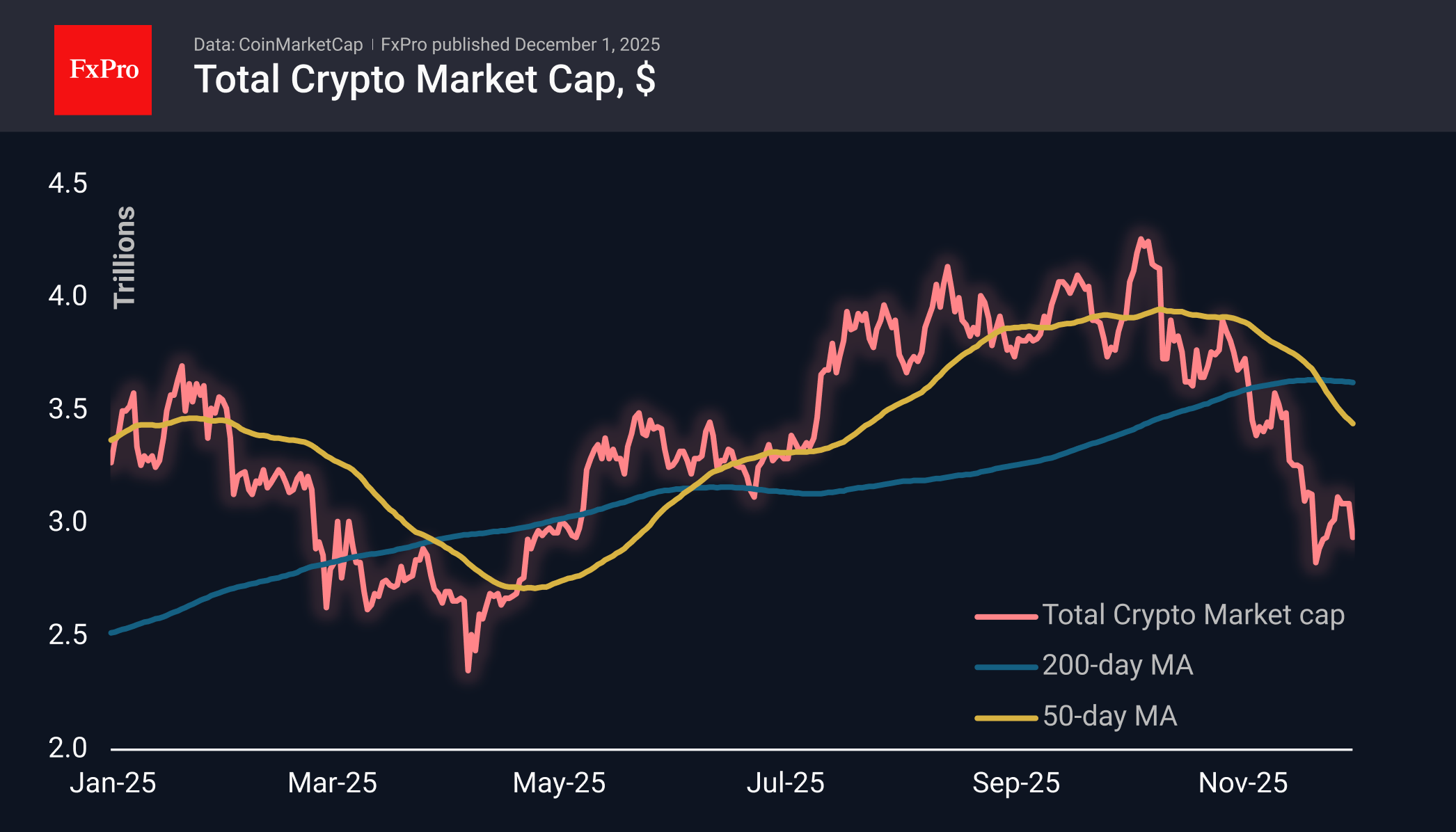

The crypto market took a painful hit at the start of trading on Monday, marking the beginning of winter and the new month with a 5% drop in 24 hours and a return below $3 trillion. This seems to be part of the Bears’ plan to create the most emotional pressure, as the beginning of the month is considered an emotional precursor for the weeks to come. The market also slipped during the period of lowest liquidity, which added drama in the form of a downward swing. Still, before the start of active trading in Europe, the market is showing signs of stabilisation and rebound.

Bitcoin fell to $85.5K on the strategy day but rebounded to $86.7K at the time of writing. Technically, a bearish picture is emerging, with the first cryptocurrency falling sharply after four days of consolidation at the 61.8% Fibonacci retracement line. Strictly speaking, we can only say that a quick rebound did not happen, but the signal for a decline to $64K (161.8%) will only be given on a drop below $80.5K.

Bitcoin fell 17.5% in November to $91.3K, marking the first decline in three years and defying the seasonal trend of one of the best months of the year. From a seasonal perspective, December is considered a relatively successful month for BTC with an average 8.7% increase. Over the past 14 years, Bitcoin has ended the month with growth on seven occasions. The average increase was 29.7%, and the average decline was 12.3%.

News Background

The inflow into the recently launched Solana ETFs in the US has continued for five consecutive weeks. Investors have poured more than $108 million into SOL ETFs in a week and nearly $620 million since the funds launched on October 28th. Inflows into spot XRP ETFs launched on 14 November in the US exceeded $666 million.

CryptoQuant points to several key on-chain indicators that are creating fertile ground for Bitcoin’s resumption of growth. One of the most significant signals is the reduction of leverage.

Bitcoin is still in the ‘high risk zone.’ Still, the situation is stabilising: selling pressure is easing, and spot demand is ‘finally beginning to shift the balance of power,’ according to Bitcoin Vector.

To continue its growth, Bitcoin needs to overcome ‘clusters of large buyer supply’ in the $93,000-96,000 and $100,000-108,000 ranges, according to Glassnode.

Bitwise points out that the last time such an ‘asymmetrical ratio’ of risk and potential return was observed in Bitcoin was during the COVID-19 pandemic, when BTC fell below $4,000.

The FxPro Analyst Team