Bitcoin gained 7.3% over the past week, ending last week near $37,700. Ethereum added 7%, while other leading altcoins in the top 10 showed mixed dynamics: from a decline of 25% over the week (Terra) to a rise of 4.6% (Binance Coin). Terra’s collapse is linked to the scandal surrounding the Wonderland DeFi protocol.

The total capitalisation of the crypto market, according to CoinGecko, rose 1.7% to $1.79 trillion for the week.

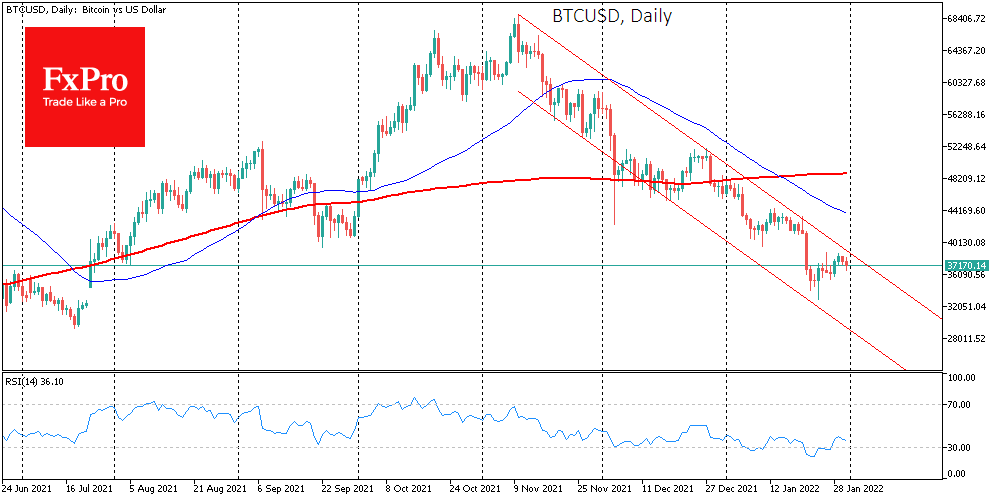

The week didn’t start encouragingly for bitcoin. The first cryptocurrency updated six-month lows below $33,000, but BTC sharply redeemed the short-term fall amid an equally sharp rebound in US stock indices.

The US stock market interrupted last week’s decline and rose for the first time after three weeks of decline.

Apple’s stock price jumped on Friday after a positive quarterly report and on Tim Cook’s statements about the great potential of the metaverse.

The rise in the stock market also contributed to the rebound in the cryptocurrency market, which again points to the strong correlation of stock and digital assets in recent times. This trend could continue at least until the end of this year.

Despite stabilisation, the situation in the crypto market remains very fragile. Bitcoin could end up falling for the third month in a row. The decline in January is over 17%, and the first cryptocurrency has already lost 45% since the highs in November.

The US Treasury Department plans to revisit the controversial FinCEN proposal for mandatory verification of bitcoin wallet users in 2022. If adopted, the proposal would require cryptocurrency exchanges to collect personal data from their users.

The FxPro Analyst Team