Market picture

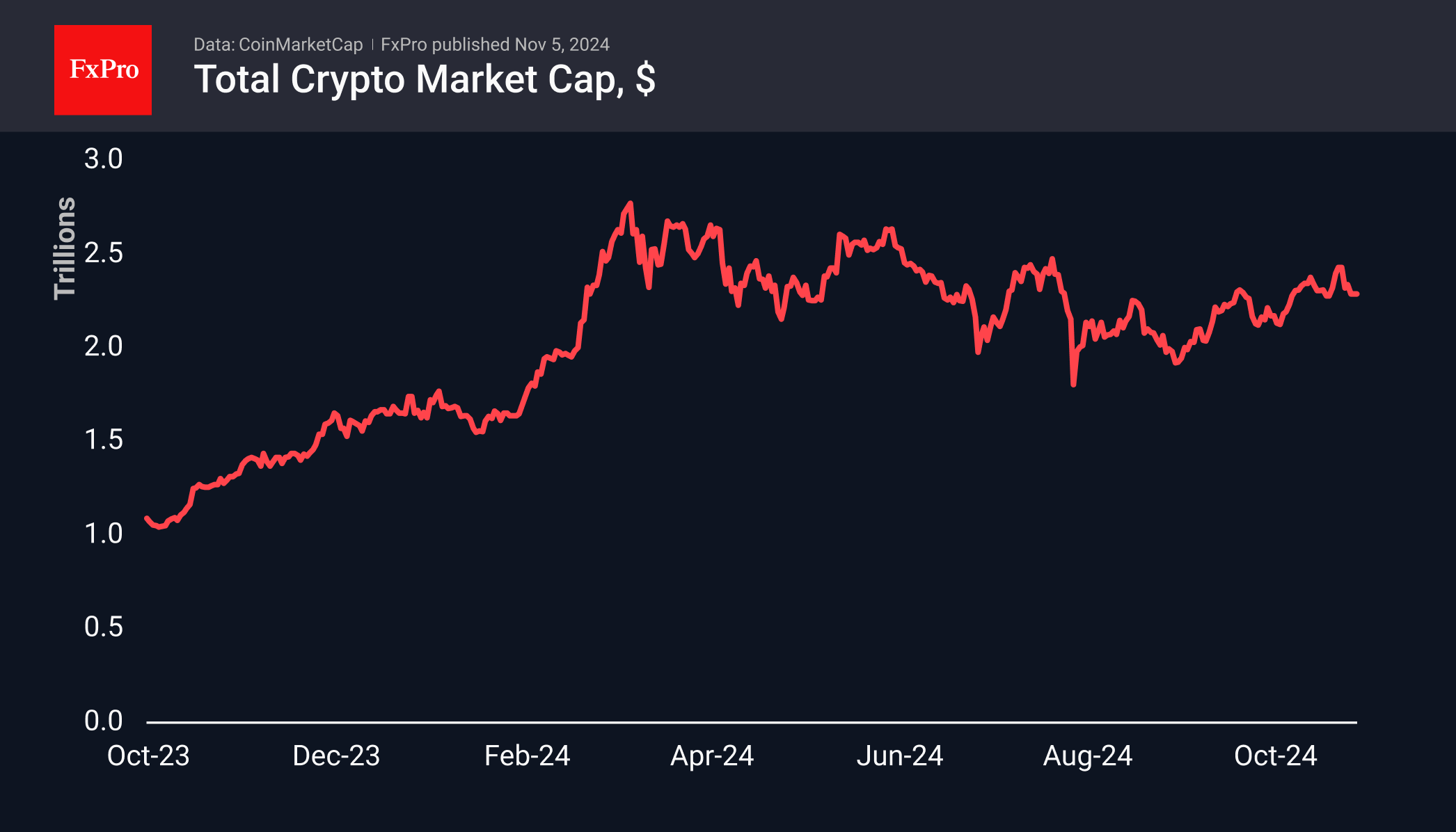

The crypto market cap remained at $2.24 trillion, a recovery after the market hit a low point at the very end of trading on Monday at $2.19 trillion. We continue to view this pullback to the lows of the past three weeks as a correction after rallying ahead of the week’s most important events: the US election and the Fed’s key rate decision. Interestingly, the cryptocurrency sentiment index remains in greed territory. It hasn’t moved outside of the 70-77 range for the past three weeks, although stock market sentiment has slipped from the threshold of extreme greed to fear over that time.

Bitcoin is about where it was 24 hours ago—just under $69K —but that description masks the drama, with a 3% decline late Monday and a sharp recovery at the start of the new day. Bitcoin was once again supported on a decline to $67K since late October. It is too early to talk about the start of an upward trend. Most likely, we are dealing with active buyers who found the last pullback attractive enough to buy in anticipation of a rally.

News background

According to CoinShares, global investments in crypto funds rose by $2.177bn last week after inflows of $901m a week earlier. The positive trend continued for the fourth consecutive week. Bitcoin investments increased by $2.156bn, Ethereum by $10m and Solana by $6m.

YTD inflows totalled a record $29.2bn, with total assets under management (AuM) surpassing $100bn for the second time in history (after June).

The options market is betting on a bitcoin ATH update before the end of November and increased volatility after the US election. Bitcoin volatility is a temporary phenomenon in the market, according to Blockstream. As technology and payment systems evolve, the volatility of the first cryptocurrency can be forgotten.

Although the supply of stablecoins is increasing, this factor alone is not enough for Bitcoin to grow significantly, CryptoQuant CEO Ki Yoon Ju said. He noted that today, only 21% of stablecoins are held on exchanges for trading purposes, while the rest are used for transfers or storage of value in countries with high inflation.

In the third quarter, investment in Solana blockchain-based applications increased 54% quarter-on-quarter to $173 million, Messari notes. The number of users paying fees online grew 109% to 1.9 million per day.

The FxPro Analyst Team