Market Picture

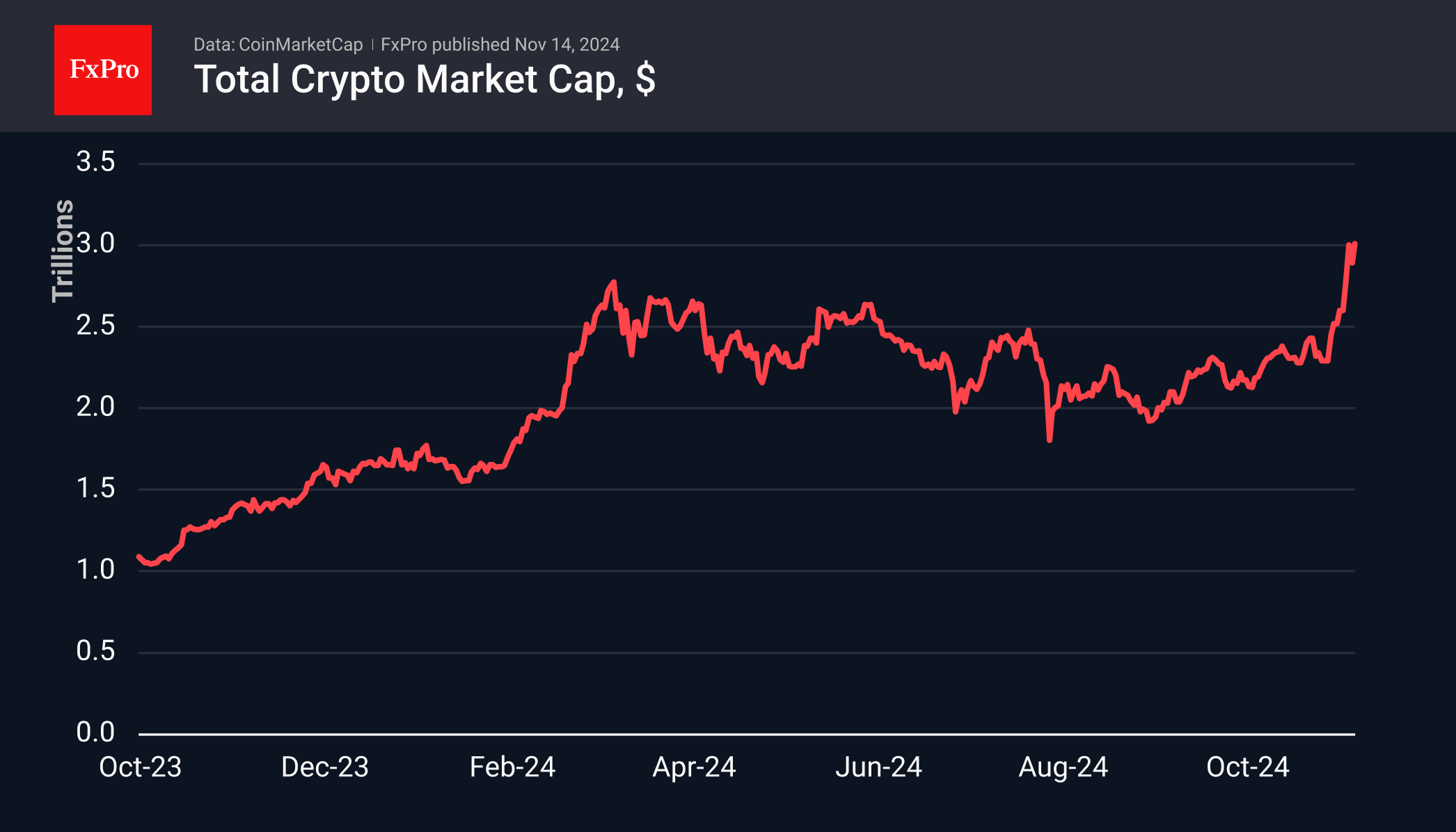

Cryptocurrencies continued to surge, pushing the total capitalisation of this market to a new high of $3 trillion. It was just $2.2 trillion on November 5th. In other words, over 10 days, the increase was more than 35%.

Bitcoin has gained nearly 20% since the start of the week, barely slowing at the $80K mark. It wasn’t until it approached $90K that we saw any significant shakeout of positions. On Wednesday, Bitcoin stormed to $93K, but after 4 hours, it was at $88K. We also saw a similar intraday range of over 5% on Tuesday.

At these levels, more and more crypto enthusiasts are switching to looking for interesting altcoins as they lock in profits in the first cryptocurrency. The easiest choice is Dogecoin, which has gained over 200% from the lows of November 3rd to the present. Given bitcoin’s 60% share of the total crypto market capitalisation, which we last saw in 2021, the altcoin season has yet to begin.

Elon Musk has joined forces with former presidential candidate Vivek Ramaswamy to lead the US government’s new Department of Government Efficiency (DOGE). The idea for DOGE was first floated in August during Musk’s interview with Donald Trump. While it has nothing to do with the cryptocurrency itself, mentions of the word are supporting the rise in price of Dogecoin, which became the first major meme coin and was created as a joke.

News Background

Glassnode notes that realised profits for both short—and long-term holders of Bitcoin remain below previous peaks at the all-time high (ATH). In such circumstances, many investors are willing to wait for higher prices to lock in profits.

According to Bitwise CIO Matt Hougan, the first cryptocurrency will remain in the “early stages” and will only enter the maturity phase when it reaches $500K. Until Bitcoin equals gold and becomes a familiar asset for central banks and institutional investors, it will remain in the “early stage.”

ConsenSys CEO Joseph Lubin said Ethereum “stands to gain more than any other cryptocurrency” from Donald Trump’s victory in the US presidential election. He attributed this to ETH’s greater ‘maturity’ compared to its competitors.

The Italian government will increase the capital gains tax on cryptocurrencies to 28%, down from the previously proposed 42%. From 2023, the country’s citizens will be obliged to pay 26% to the state if the profit from cryptocurrencies exceeds €2,000.

The FxPro Analyst Team