Market Overview

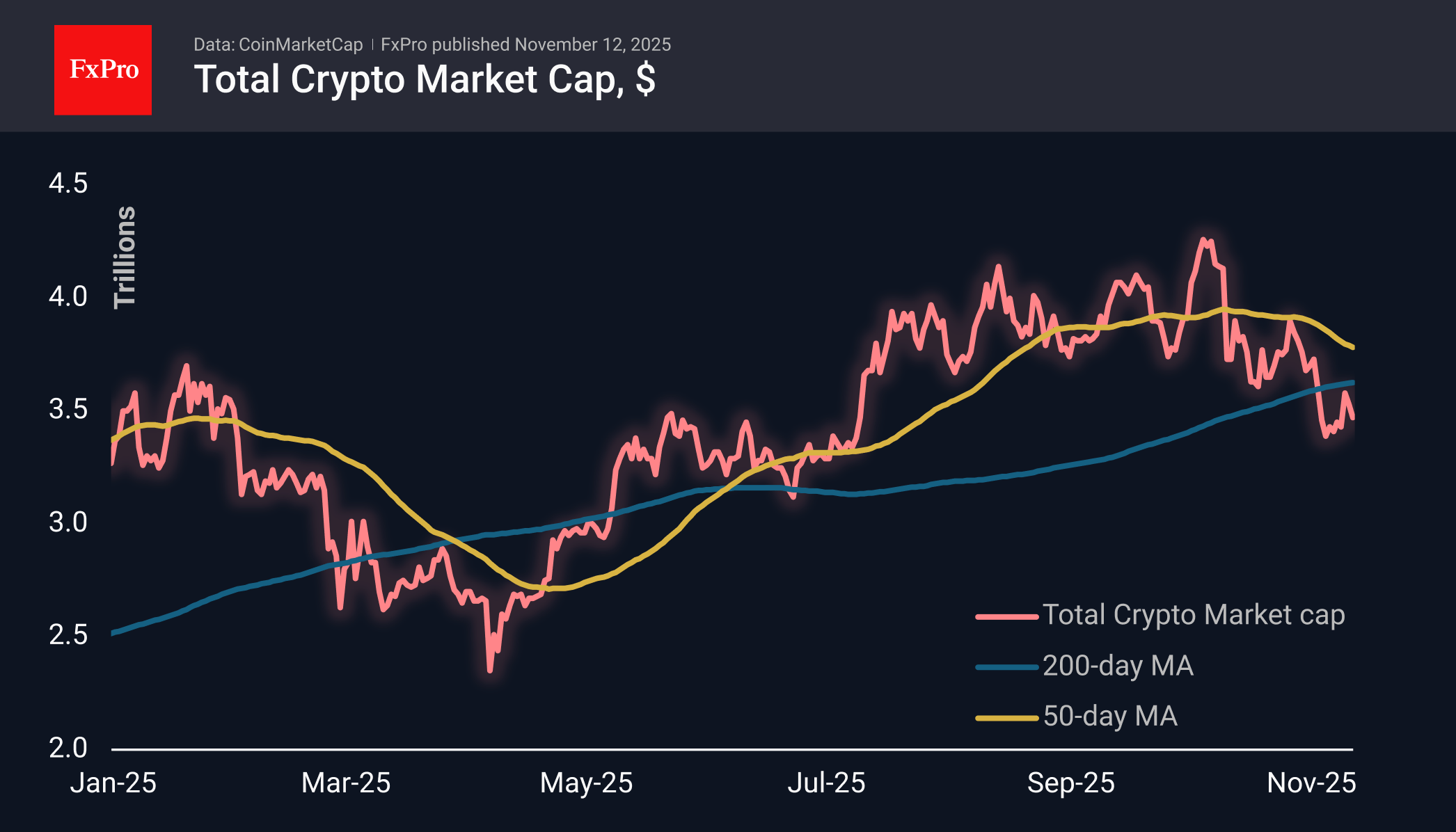

The crypto market cap continues to decline, losing nearly 2% over the past 24 hours to $3.47 trillion. Thus, the market remains within the downward trend that formed just over a month ago. Within this trend, there is potential for a decline to the next local lows of around 9%, and the market could rush towards the $3.2 trillion mark in the coming days.

The sentiment index at 24 remains on the border between fear and extreme fear. As in the spring, it will take a long time for sentiment to reverse. Since the end of September, Bitcoin has been regaining its share of the crypto market, which was lost in July.

Bitcoin recorded a local low of $102.5K at the start of the day, later rising above $103K. In the short term, BTC bulls are attempting to form a bottom, but the acceleration in growth is being countered by heavy selling, and the overall picture aligns with a larger downtrend.

News Background

Large investors who bought Bitcoin at prices around $110.8K are recording massive losses in recent days, according to CryptoQuant. However, the selling pressure is partially offset by new buyers.

Institutional investors are confident in a cryptocurrency rally before the end of the year. According to a survey by digital bank Sygnum, more than 61% of respondents intend to increase their investments in crypto assets. In their opinion, the launch of altcoin-based ETFs and the adoption of bills on the structure of the cryptocurrency market will sustain the bullish cycle in 2026.

Strategy bought 487 bitcoins (~$50 million) over the past week at an average price of $102,557 per coin. Strategy now owns 641,692 BTC worth $47.54 billion. During its recent IPO on the European stock market, Strategy raised more than $700 million to secure its preferred shares.

Large investors have resumed buying Ethereum after the recent correction. At the same time, retail traders are cautious, notes ShayanMarkets analyst.

Ethereum reserves on Binance have dropped to their lowest level since May last year, according to CryptoQuant. This is traditionally seen as a bullish signal in the medium term.

The market capitalisation of altcoins still maintains a critically important level of support, according to analyst Michael van de Poppe. In his opinion, the bull market is far from over and is expected to reach new heights in 2026.

The FxPro Analyst Team