Market Picture

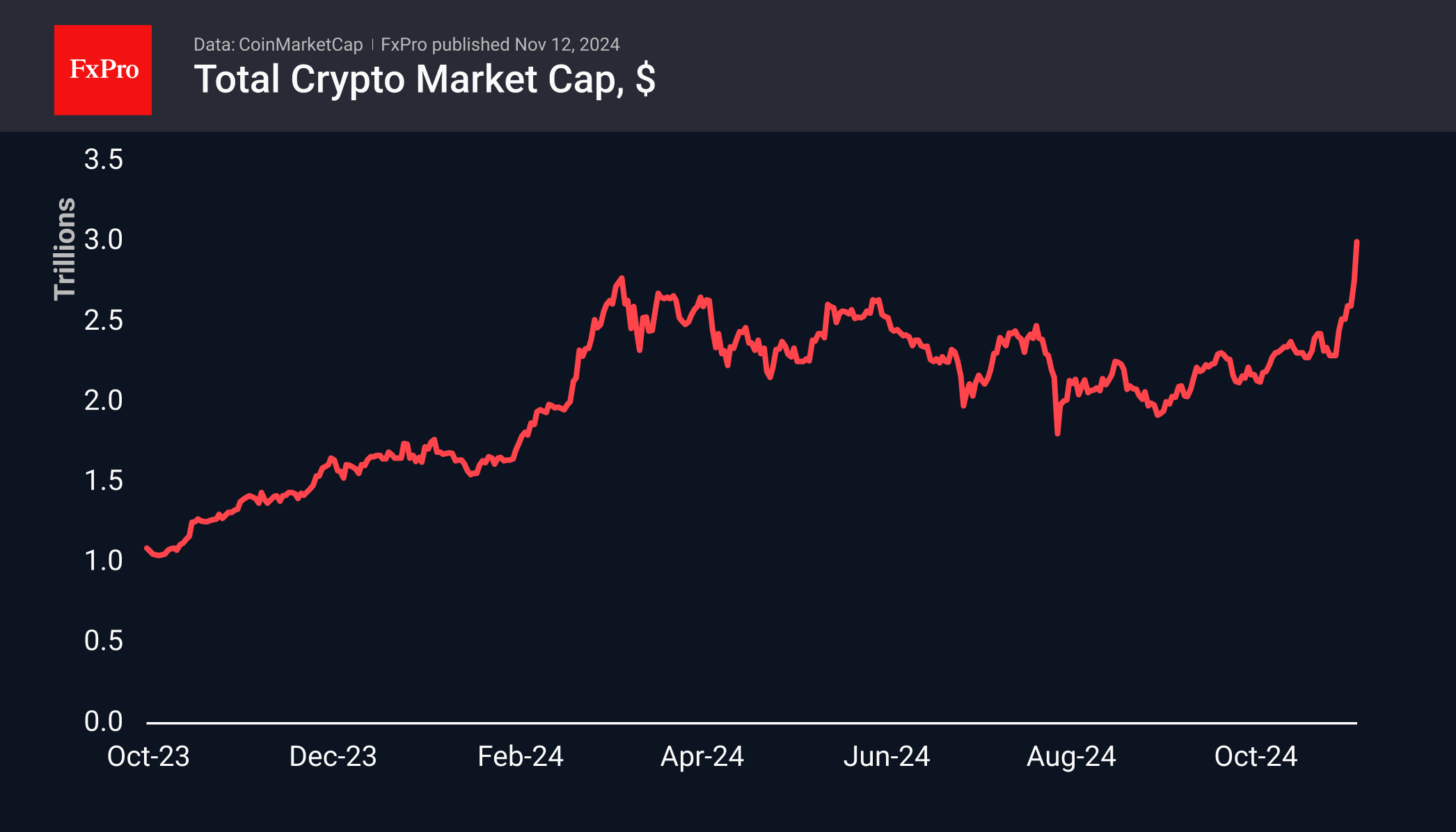

The total capitalisation of the cryptocurrency market approached $3 trillion, rewriting the record set almost exactly three years ago. During the day, the indicator grew by more than 8%. The nature of the movement indicates the liquidation of short positions in the largest coins, primarily bitcoin. At the same time, individual altcoins are increasingly shooting up.

The first cryptocurrency soared almost 10% in 24 hours, coming close to $90K, although only a little over a day ago, it tried to consolidate at $80K. Reaching the $100-110K target area now looks like a matter of a couple of weeks or even days.

Dogecoin is even more actively destroying sceptics with open positions. In 24 hours, it soared 44% to $0.4. It traded sustainably higher for only 15 days in May 2021. This area was pivotal in April and June that year, so it’s worth paying extra attention to it this time around as well.

News Background

According to CoinShares, global crypto fund investments rose by $1.978bn last week after inflows of $2.177bn previously. The positive trend continued for the fifth consecutive week. Investments in Bitcoin increased by $1.796bn, Ethereum by $157m, and Solana by $4m. Investments in funds with multiple crypto assets increased by $23m.

Inflows into crypto-ETFs since the beginning of the year reached $31.3bn. Due to price growth, global assets under management reached a new all-time high of $116bn. Trading volumes rose to their highest level since April. The combination of a favourable macroeconomic environment (Fed rate cuts) and seismic shifts in the US political system (after Trump’s victory) are likely reasons for such favourable investor sentiment, CoinShares suggests.

According to founder Michael Saylor, MicroStrategy bought an additional 27,200 BTC between 31 October and 10 November for $2.03 billion (at ~$74,463 per coin). The firm now holds 279,420 BTC, acquired for $11.9bn at an average exchange rate of $42,692.

MN Consultancy head Michael van de Poppe said that the much-anticipated altcoin season has begun in the background of Bitcoin’s new all-time highs. He described Ethereum’s rise in recent days as impressive. The altcoin bull cycle could last until 2026 or 2027 and transform into a full-blown Supercycle.

In the past few days, the bankrupt FTX has filed 23 lawsuits against various companies and individuals to recover funds from creditors. In the lawsuit against Binance, FTX’s lawyers are demanding the return of $1.8bn paid as part of a share buyback in 2021.

The FxPro Analyst Team