Market Picture

The cryptocurrency market spent Monday in a very narrow range but started Tuesday with a violent sell-off, losing over 2.8% in 24 hours to $2.47 trillion. Bitcoin is retreating at the same pace as the market as a whole, while Ethereum is down 3.5%. Top altcoins are losing between 2% (Cardano) and 6.6% (BNB), and Tron is temporarily standing out from the crowd, adding 0.25%. This wariness of cryptocurrency traders may be a manifestation of the downturn in risk appetite in global markets, which may soon establish itself in the dynamics of equities and commodities.

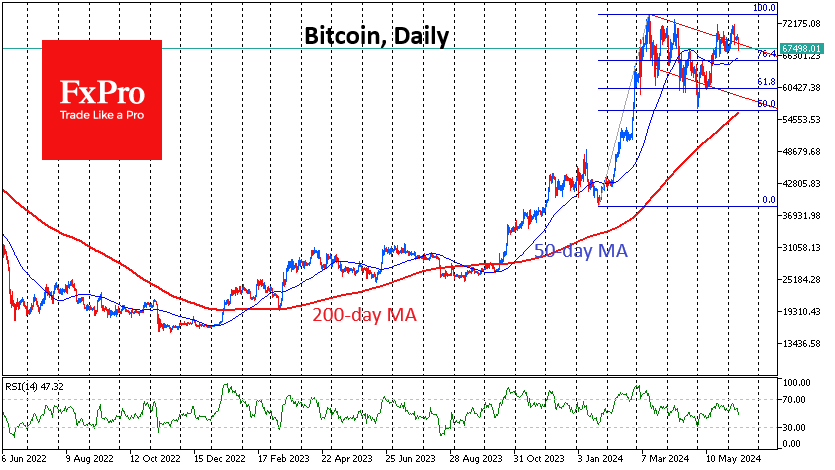

Bitcoin has pulled back to $67.6K, returning to the local lows at the beginning of the month. This decisive move downward indicates that a deeper correction is in store. We can see just how strong the bearish sentiment is by the first cryptocurrency’s momentum near $65K, an intermediate round level near where the 50-day moving average and 76.4% Fibonacci retracement level of the rally from the January lows lie. A quick dip below would force a search for support no sooner than $60K.

Cardano, whose relative performance is better than its peers, is in a rather vulnerable position in the medium term, testing support for the past two months at $0.43. It is currently trading in the lower half of the range from the October lows, under the 200- and 50-day moving averages. A failure of support potentially opens the way down to $0.38 or even $0.25.

News background

According to CoinShares, crypto fund investments rose by a record $2.038bn last week, after inflows of $185m a week earlier; the figure marks the fifth consecutive week of growth. Bitcoin investments increased by $1.973bn, Ethereum by $69m and Solana by $0.7m.

The total assets under management (AUM) of all spot bitcoin funds is about $61.1bn. In five months, BTC-ETFs have accumulated 60% of the AUM of gold investment products ($105bn) that have been around for more than 20 years.

Weekly trading volumes for the week rose 55% to $12.8bn.

The market recorded a new record high in short hedge fund positions in bitcoin, indicating a significant change in sentiment among investors, according to the financial portal Zerohedge. Bearish hedge fund positions negatively affect the sentiment of other market participants and lead to increased volatility.

According to a study by the Bank of New York Mellon, family wealth managers are willing to allocate about 5% of their investment portfolio to cryptocurrencies. The main factors preventing this are hacker attacks and cybercrime.

The total blocked value of assets (TVL) in the Ethereum-based Tier 2 Base network is over $8bn, surpassing OP Mainnet from the Optimism team. The protocol from Coinbase is now the second largest Ethereum scaling solution, behind only Arbitrum One with $18.27bn.

The team of Notcoin, a Web3 gaming project, reported that its user base has grown to 40 million people. According to the developers’ calculations, players have already earned $1.5 million in TON through 20 campaigns. The team expects this figure to grow tenfold after automating new missions that third-party projects will be able to launch independently.

The FxPro Analyst Team