Market picture

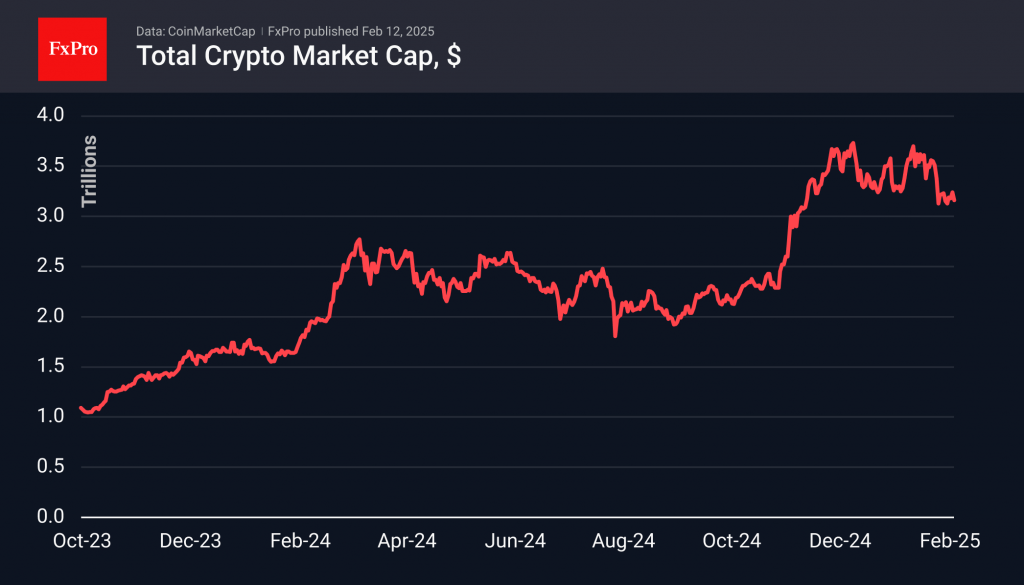

The crypto market continues to bump along, pulling back 2.7% to $3.15 trillion after flirting with the $3.3 mark the day before. This week, the market is hovering near the lower boundary of the descending corridor.

Technically, a rebound from these levels is more likely. However, the wiser approach is to wait, as the risk of a sharper decline remains high after an extended period of weakness.

The cryptocurrency sentiment index is hovering between the fringes of fear and neutral territory, having lost 1 point to 46 by Wednesday morning. Still, the market lacks enough fear to attract buyers.

On Tuesday, Bitcoin once again rebounded from its 50-day moving average near $98,600, a strong resistance level over the past week. However, intraday buying interest on dips below $95,000 remains evident. The RSI dynamics align with sentiment index trends, suggesting that a deeper move into oversold territory may be needed to attract buyers.

News Background

Galaxy Digital CEO Mike Novogratz expects Bitcoin to be on the government’s books in six months. He also expects that following the SEC leadership change, many cryptocurrency companies, including Galaxy Digital, will go public and list their shares on the New York Stock Exchange or Nasdaq.

Strategy, which had temporarily paused its initial cryptocurrency purchases, has now resumed buying Bitcoin. Last week, the company acquired 7,633 BTC for $742.2 million at an average price of approximately $97,255.

Strategy (formerly MicroStrategy) holds 478,740 BTC, purchased for a combined $31bn at an average price of $65,033 per coin.

Santiment estimates that market participant interest has definitively shifted from meme coins to Bitcoin and leading alts. Leading Tier 1 blockchains, including Ethereum, Solana, Toncoin and Cardano, account for 44% of all cryptocurrency discussions on social media.

Bloomberg cites Litecoin (LTC), Solana (SOL), XRP, and Dogecoin (DOGE) as having high odds of ETF approval. For LTC and DOGE, the U.S. Securities and Exchange Commission (SEC) has already accepted Forms 19b-4 for review.

In the 19 days since the launch of Official Trump (TRUMP), the volume of accumulated losses from investments in the US president’s meme-coin has reached $2bn, the NYT estimates. More than 810,000 users have experienced losses.

The FxPro Analyst Team