Market picture

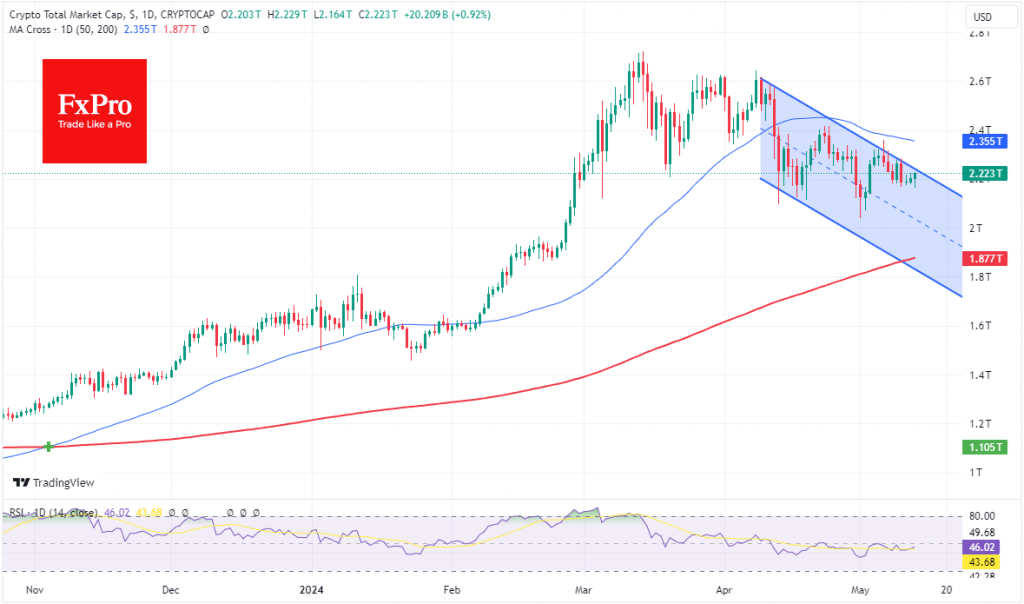

Crypto market cap on Monday stands at $2.2 trillion, down 5.2% over seven days, although it showed some growth over the weekend. Local market capitalisation peaked on March 14th, but the active decline began about a month ago, with a sequence of lower lows and lower highs.

During the previous week, the crypto market held near the upper boundary of the descending channel. Cryptocurrencies are being helped by increased risk traction in stock markets. Still, there is also internal pressure, likely related to asset sell-offs by miners and fears of tighter regulation of cryptocurrencies.

Bitcoin is largely negatively impacting the overall performance of the crypto market right now. However, it has been finding plenty of buyer interest over the past two months, on a decline towards $60K. A failure below it could trigger something of a panic sell-off. The positive scenario, in our opinion, will become the main one with a rise above $65K, fixing the price at the 50-day moving average and the reversal area in early May.

News background

US venture capital fund Pantera Capital said it has invested a record amount in TON, which has not yet been disclosed. Pantera attributed the decision to invest in TON to the project’s potential to become one of the largest crypto networks. Toncoin (TON) rose nearly 20 per cent over the week, showing the best growth in the top 100 cryptocurrencies.

Ethereum co-founder Joseph Lubin said the US SEC is deliberately hindering innovation, threatening the future of the country’s financial system. According to him, “It looks like the SEC has reclassified Ethereum into a security without telling anyone.”

ARK Invest and 21Shares have excluded staking from the application to launch a spot Ethereum-ETF. This situation may indicate an attempt to “tidy up the paperwork” based on SEC comments despite the lack of official statements, according to Bloomberg.

Factor’s CEO Peter Brandt suggested that cryptocurrency staking could soon be recognised as an illegal activity.

According to a report for the SEC, Susquehanna, a trading and technology behemoth with $481bn in assets under management, has invested $1.2bn in various spot bitcoin ETFs.

The FxPro Analyst Team