Market picture

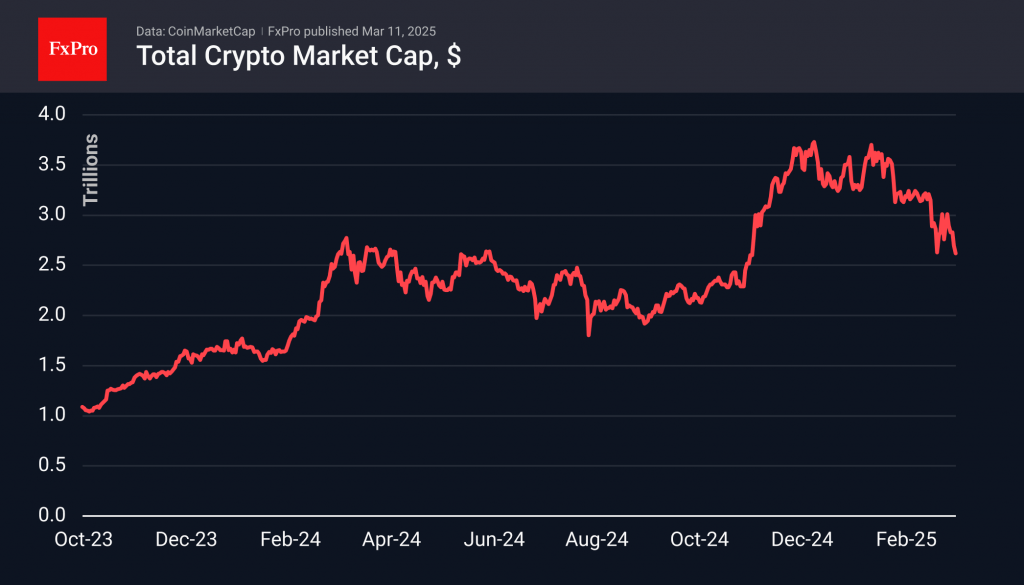

Crypto market capitalisation has been falling to $2.5 trillion following the rumbling fall of the US stock market. It is dipping below the peaks of early 2024 and late 2021. Previously, a similar decline would complete a corrective pullback, attracting buyers. However, the chances of such an outcome are now lower than in previous years due to the powerful influence of traditional financial companies, which has strengthened the link between the crypto market and stock dynamics.

For now, though, we can argue that there is less terror in crypto. The Fear and Greed Index is at 24 (+4 points for the day), while the low point was a week earlier at 10.

Bitcoin slipped towards $76.5K in the early hours of Tuesday but has popped above $80K at the time of writing, approaching Monday’s consolidation levels. A bearish pattern persists on the daily timeframes, which suggests a strengthening sell-off after a failure under the 200-day moving average. The scenario of a pullback to the $70-74K area still looks the most probable for us. This is all the truer as the consolidation and rebound in early March has taken the short-term oversold stance out of the market.

Ethereum is trying to find a pivot point after falling towards $1750 at the start of Tuesday. These were the lowest values in the last 17 months. On weekly timeframes, the RSI oscillator hit its lowest point since mid-2022 – near the bottom of the bear market. Does this signify an opportunity for the recklessly bold or a breakdown in the leading altcoin? We will find out in the coming days.

News background

According to CoinShares, global crypto fund investments fell by $876 million last week after record outflows of $2.911 billion a week earlier. Investments in Bitcoin fell by $756 million; in Ethereum, by $89 million. Investments in Solana rose by $16 million, in XRP by $6 million, and in Sui by $3 million.

Another recalculation increased Bitcoin mining difficulty by 1.43% to 112.15T. The growth did not compensate for a 3.15% drop two weeks ago. However, the figure came close to the all-time high of 114.17T reached in January.

Strategy (former MicroStrategy) intends to raise $21bn through the sale of preferred shares as part of its At-The-Market program. The proceeds will be used to buy Bitcoin and other corporate purposes.

The FxPro Analyst Team