Market picture

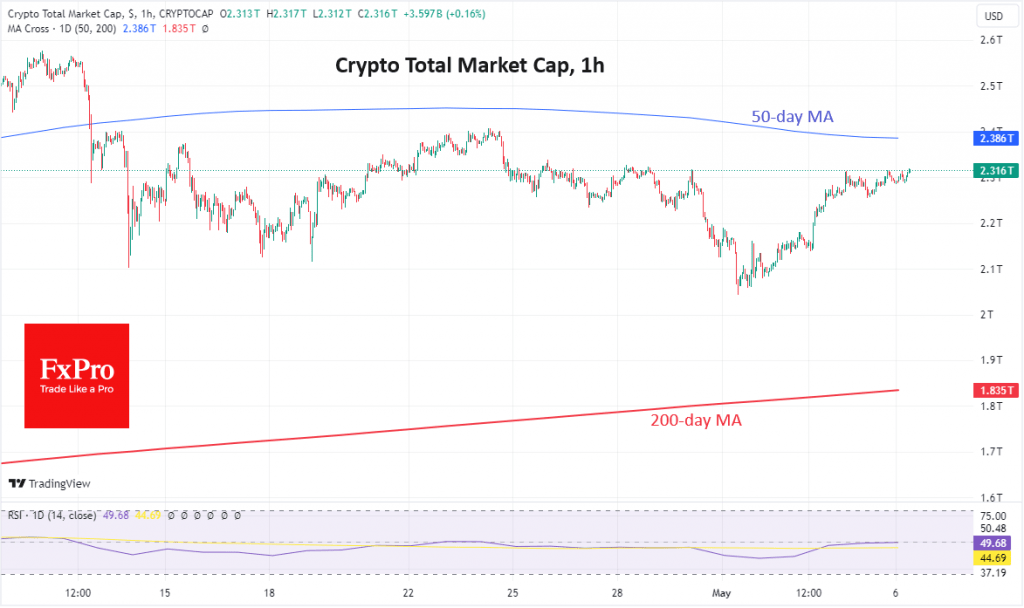

Crypto market capitalisation has been up 2% over the past seven days and has added over 13% from the lows of the 1st of May. A timid bottom formation on Wednesday was followed by a modest rebound on Thursday and more robust buying on Friday after the monthly US jobs report. Over the weekend and at the start of the day on Monday, the crypto market’s growth was halted in a 10-day resistance area near $2.31 trillion.

Bitcoin’s upward surge from the beginning of the month to $64.4K by the start of active trading in Europe on Monday allowed the weekly candle to close higher, showing that buyers are ready to buy back deep drawdowns. On daily timeframes, Bitcoin managed to break above the descending resistance line. To confirm a bullish reversal in this case, it is necessary to consolidate the price above $65K.

We assume that the dynamics of BTCUSD around the 50-day moving average going through $65.7K on Monday could hold considerably greater importance.

News background

Bitcoin’s post-halving pullback was a ‘necessary market clean-up’, and BTC will consolidate above $70K by the end of August, according to ex-CEO of BitMEX Arthur Hayes. The recovery will be made possible by increased dollar liquidity. The Fed has reduced the monthly limit on the redemption of Treasury securities from $60bn to $25bn, which Hayes called a ‘hidden printing press’.

Block, a payment company owned by Jack Dorsey, has pledged to allocate 10% of its monthly profits to Bitcoin by the end of the year. Block began building a position in October 2020 and currently has 8,027 BTC on its balance sheet.

Michael Saylor, the founder of MicroStrategy, has called Ethereum a security and suggested that the US SEC will never approve a spot Ethereum-ETF for this reason.

USDT issuer Tether and security firm Chainalysis have partnered to create a system to track USDT transactions in the secondary market.

Bitfinex CTO Paolo Ardoino denied that the exchange’s user data was leaked. On 26th April, hackers claimed to have breached Bitfinex’s security systems and obtained 2.5 TB of information and personal data of 400,000 users.

The total value locked (TVL) in Solana-based staking platform Jito Network (JTO) reached $1.42bn, making it the largest protocol on the network. According to the team, the volume of coins blocked in the protocol exceeded 10 million SOL.

The FxPro Analyst Team