Market Picture

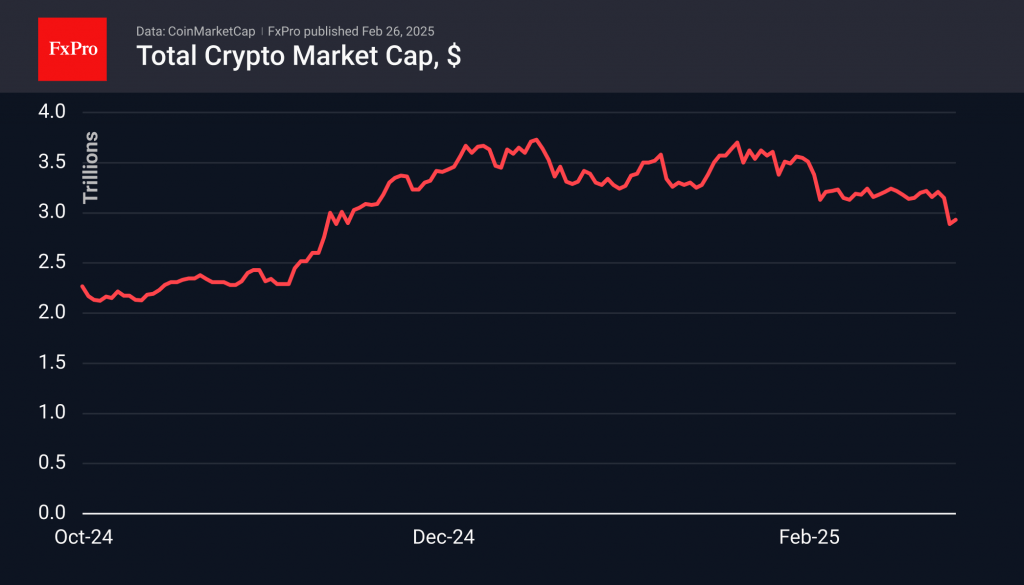

The crypto market fell below the support for the last three months on Tuesday, going into a brutal sell-off mode. Institutional investor sentiment didn’t help either, as US stock indices also saw a sell-off. Sentiment stabilised on Wednesday, and we see an attempt to form a bottom, pushing off from the $2.87T market cap and now up to $2.93T.

The cryptocurrency index has pulled back to the extreme fear area at 21, its lowest value since August last year. Earlier, we pointed out that the market lacked the drop into the fear region to attract greedy speculators. But now the question is whether those speculators have enough courage to buy.

Bitcoin broke through support in the 92000 area on Tuesday, near where the 61.8% retracement level of the November-December rally was. Bitcoin has given up half of the gains of that rally. The local target for the bears now looks like the area of the 200-day moving average at 82000. But already, Bitcoin is walking the edge of a bear market, losing about 20% from the peak. Further declines could open the floodgates for expanded liquidation of long positions in the crypto. As usual, saying, ‘I’ll be greedy when everyone else is scared,’ is much easier when you don’t have skin in the game.

Ethereum and Solana have already rolled back to October-November levels, with huge technical potential for further capitulation. In the event of a further sell-off, Ethereum could fall another 35% to $1600, while Solana faces a much steeper potential decline of over 80% from its current price.

News Background

Bitcoin will fall to $70,000 if hedge funds liquidate positions in spot bitcoin ETFs, ex-BitMEX chief Arthur Hayes said. He noted that the funds are focused on gaining the so-called ‘basis spread,’ which is generated by the difference between longs in ETFs and shorts on CME-traded futures. The strategy looks attractive if its profit exceeds the yield on short-term US government bonds.

Strategy last week bought an additional 20,356 BTC for $1.99bn at an average price of $97,514. The company now holds 499,096 BTC worth $33.1bn at an average price of $66,357.

Pectra’s update to Holesky’s Ethereum testnet didn’t go according to plan, so the network stopped finalising slots. A bug related to Holesky’s features has already been identified, and it does not affect the main network in any way.

OKX will pay more than $504 million in settlement of the US Department of Justice claims. The exchange pleaded guilty to operating an unlicensed money transfer business in the US.

The FxPro Analyst Team