Market Overview

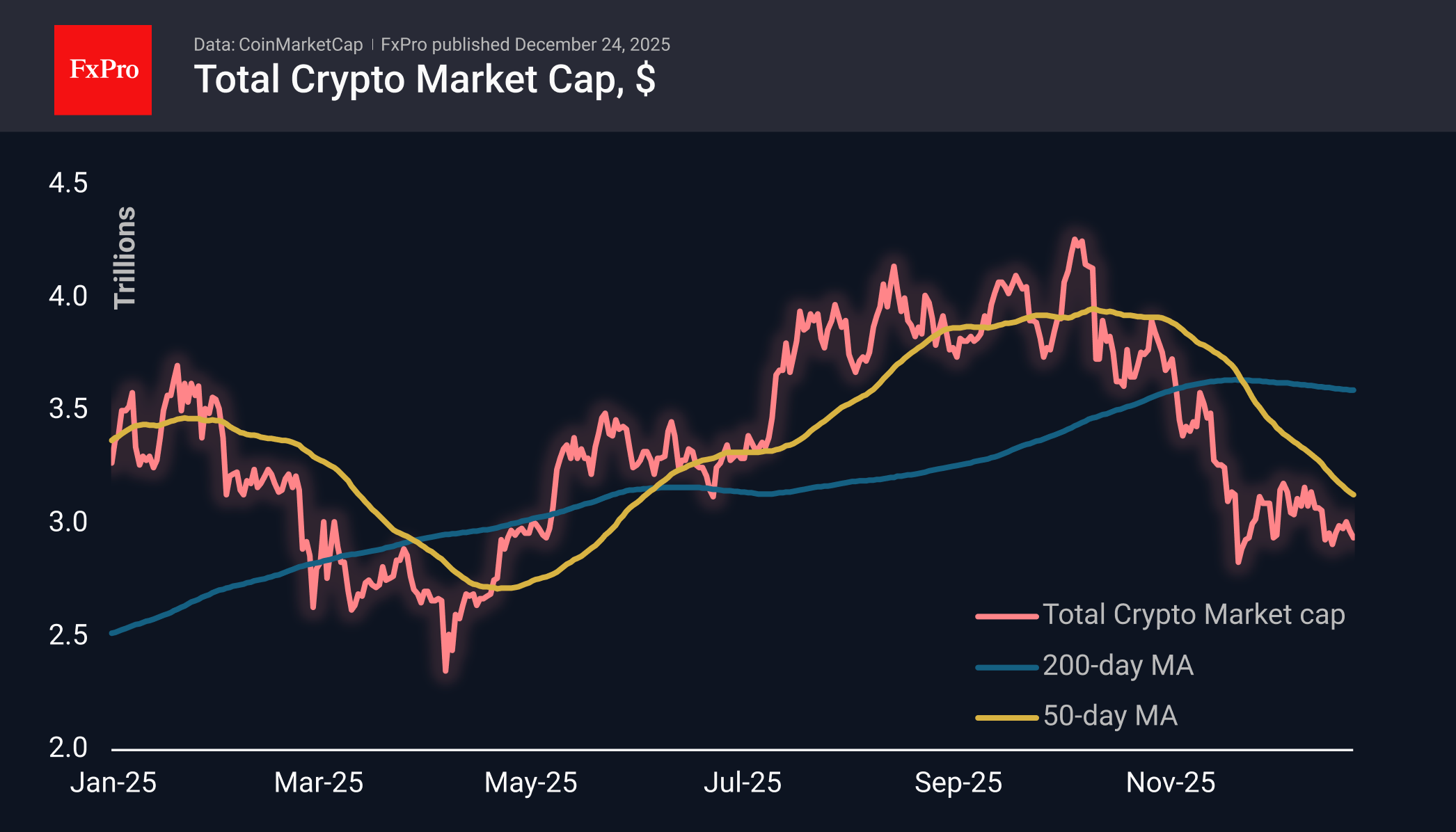

The crypto market cap declined 1.7% over the past day and 15% or $0.5 trillion over the past year, reaching $ 2.94 trillion. This weak performance contrasts sharply with the 17% growth of the Nasdaq-100 and 70% growth of gold, which it has often followed in previous years. Neither the Trump family’s enthusiasm for cryptocurrencies, the rate cut, the return of institutional investors, nor even a weaker dollar managed to support the market.

At the time of writing, Bitcoin is trading below $87K, slowly sliding down due to a combination of reduced volatility and an inability to consolidate above $90K earlier in the week. The cautious nature of this week’s movement is due to major players entering holiday mode. However, we are watching with concern as the price approaches local lows of $85K. A fall below this price during the holidays could trigger a surge in sales. Perhaps this is what the bears are aiming for — to find the point after which the market will roll down on its own, potentially seeking to repeat the collapse of October 11th. In this case, it is worth watching closely what follows: a sharp reversal after the culmination of the sell-off, or a crypto winter. The highs of other markets are working towards a bullish scenario, while the 4-year cycles are working towards a bearish one.

News Background

The quarter coming to an end may be the worst in seven years. Bitcoin has lost more than 23% since the beginning of October, according to CoinGlass. The cryptocurrency market did not experience the traditional Christmas rally, indicating that its participants are unwilling to take investment risks.

At QCP Capital, the primary concern for the crypto market at present is a sharp decline in liquidity, as traders are closing their positions en masse ahead of the holidays to mitigate their volatility risks. However, this is creating an overall adverse effect.

In the month ending December 15th, the Bitcoin network’s hash rate declined by 4%, marking the largest drop since April 2024. VanEck believes that miner capitulation is historically a bullish signal for the asset.

The DAT company ETHZilla, supported by Peter Thiel, sold 24,291 ETH worth $74.5 million to repay its debt obligations. The firm has approximately 69,800 ETH, worth $206 million, remaining on its balance sheet. ETHZilla’s shares have plummeted more than 65% since the beginning of the year.

Meanwhile, BitMine continues to increase its Ethereum reserves steadily. However, Michael Saylor’s Strategy paused its Bitcoin purchases last week, increasing its dollar reserves.

85% of altcoins launched in 2025 have fallen below their market launch price, according to Memento Research. At the same time, two-thirds of the 118 tokens analysed have lost more than 50% of their value.

The FxPro Analyst Team