Market Picture

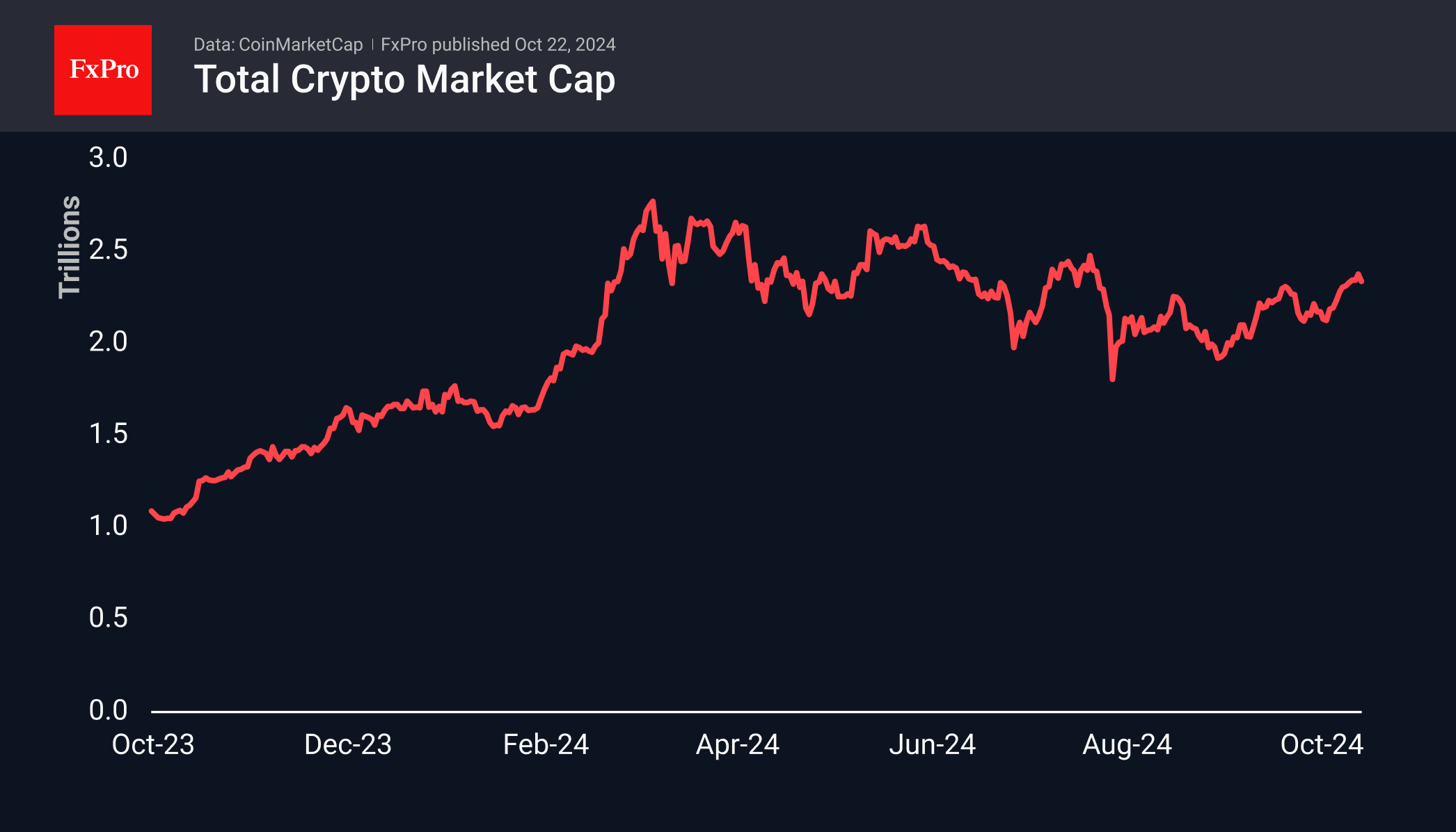

Cryptocurrency capitalisation has corrected 1.8% over the past 24 hours to $2.34 trillion. However, these figures reflect a partial recovery from earlier lows of around $2.27 trillion earlier in the day. For now, this appears to be a case of profit-taking during the upward trend, but it’s worth keeping an eye on the market dynamics over the next few days.

Stablecoin volume has not increased since late September, setting up a potential pause in the growth of the broader cryptocurrency market, as stablecoins are often seen as liquidity for quick purchases of coins of interest. The previous growth momentum was from August to September, when the overall crypto market capitalisation pushed off the bottom.

The main reason for the entire crypto market’s subsidence seems to be Bitcoin, which the bears defended against an assault on the $70K level. They intensified selling at $69.5K early in the day on Monday and dropped the price to $66.5K on Tuesday morning.

News Background

According to CoinShares, global investment in cryptocurrency funds rose to $2.199 billion last week, following inflows of $407 million the week before. The figure was the highest in the last 13 weeks. Investments in Bitcoin rose by $2.134 billion, Ethereum by $58 million, and Solana by $2.4 million. Investments in multi-crypto asset funds decreased by $5 million.

Trading volume grew by 30%, and assets under management approached $100 billion.

According to Coinglass, total open interest (OI) in bitcoin futures reached a record $40.6 billion. In terms of coins, the figure was 592,000 BTC, the highest since December 2022.

The Bitcoin network’s hashrate updated the historical maximum. On October 19, it reached 791 EH/s for the first time, according to data from Cloverpool (formerly BTC.com), reflecting miners’ capacity build-up. The seven-day average hash rate reached 703 EH/s, according to Glassnode.

According to JPMorgan, US-listed public miners achieved a record 28.9% share of the global Bitcoin hashrate in October. Since the halving, these companies have increased their share by 8%, highlighting their ‘efficiency and financial advantages’.

The FxPro Analyst Team