Market Overview

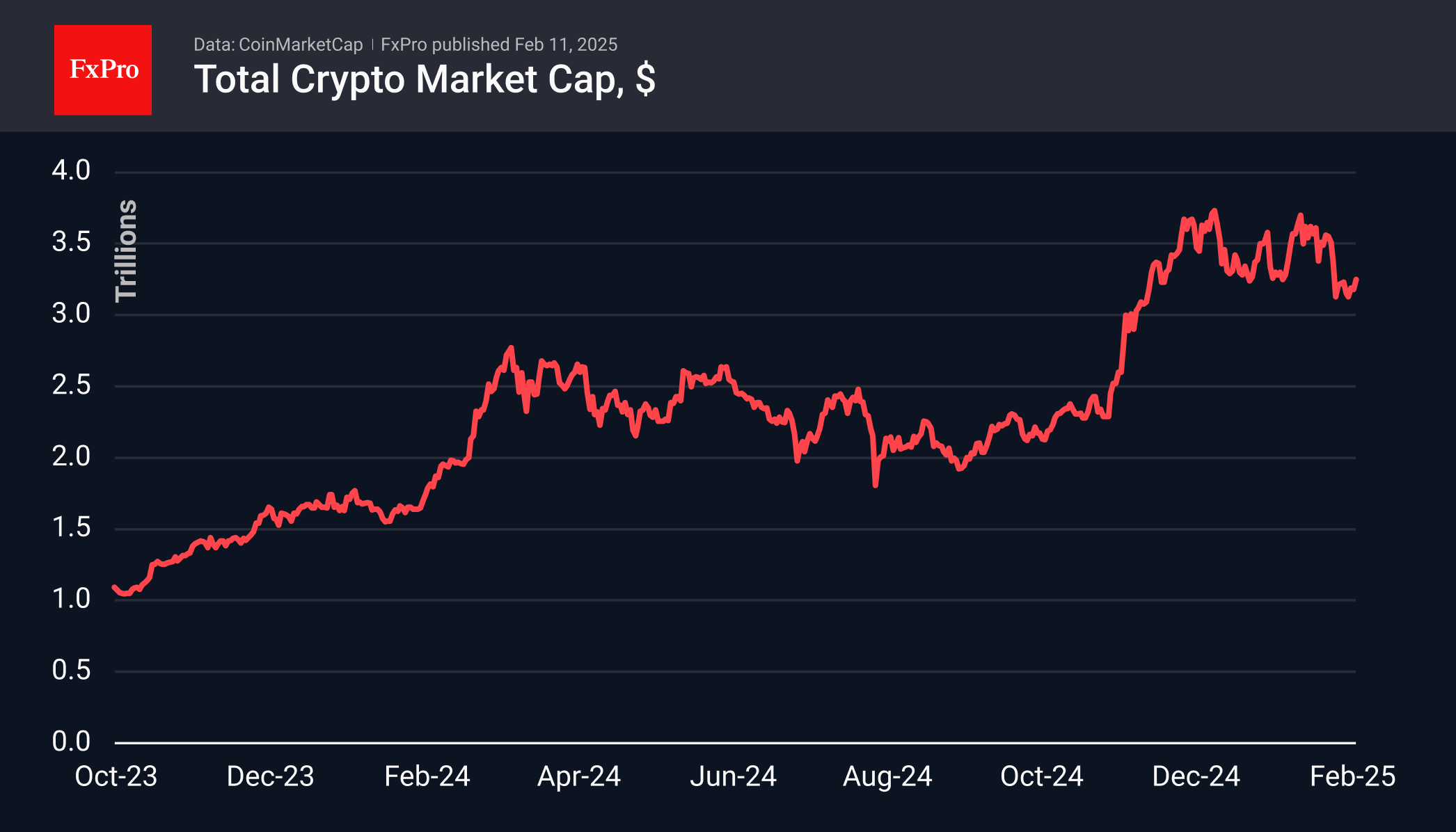

The total capitalisation of cryptocurrencies increased by 2.5% over the last 24 hours, moving away from the lower boundary of the local range. However, at $3.25 trillion, the market remains nearly unchanged from the previous week. Despite record highs in gold and European stocks, along with strong performance in U.S. securities, cryptocurrencies remain out of favour with buyers.

The cryptocurrency fear index was on the borderline between fear and neutral sentiment. There has been no quick recovery, and the lack of a dip in the fear zone has deterred some buyers from being active.

Bitcoin has traded below its 50-day moving average since early February and has stopped rising since mid-December, remaining within a long correction. A fall below 92,500 could trigger a deeper sell-off. However, given the positivity in other markets, there are signs that the decline is attracting new buyers.

News Background

According to CoinShares, global investment in crypto funds more than doubled last week to $1.26bn, with Bitcoin investments up $407m, Ethereum up a significant $793m, XRP up $21m, Solana up $11m, and Sui up $4m.

Ethereum took centre stage last week as its price dropped to nearly $2,100, prompting significant buying, according to CoinShares.

Tiger21 founder Michael Sonnenfeld said Bitcoin has become a capital preservation tool for wealthy investors. Among his network of ultra-wealthy investors, BTC holdings typically range from 1% to 3% of their portfolios. In the latest adjustment, Bitcoin’s mining difficulty rose by 5.61%, hitting a record high of 114.17T. Just two weeks ago, it saw its first decline since September 2024, driven by a cold snap in the U.S.

The Nasdaq exchange filed Form 19b-4 with the SEC to launch spot ETFs from CoinShares based on XRP and Litecoin. With the new instruments, the European issuing firm will expand its presence in the US market amid an expected softening regulatory environment.

The FxPro Analyst Team