Market Picture

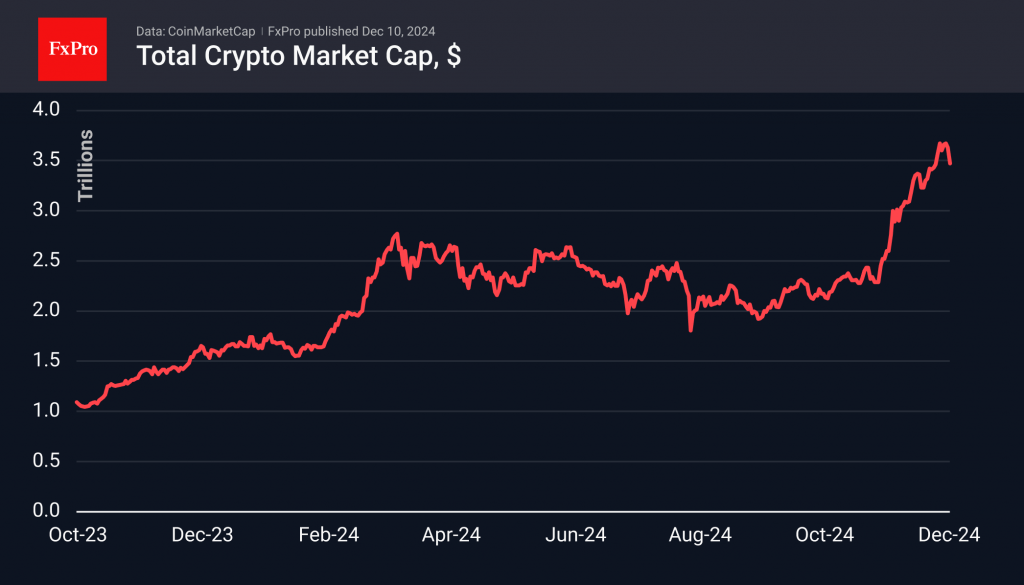

Crypto market capitalisation has fallen 4% in the last 24 hours to 3.4 trillion, taking a hit from another failed attempt by Bitcoin to break above 100k. As one would expect, the failure of the leading coin to grow is sparking hesitation among supporters of smaller and more volatile coins.

The Cryptocurrency Fear and Greed Index is at 78 (extreme greed), as it was the day before, but it now looks like a lagging indicator that doesn’t account for the latest dip.

The bulls in Bitcoin once again failed to consolidate above 100K on Monday, which was followed by an impressive sell-off, bringing the price to 94K at the lowest point. There is still a wall of orders clearly visible intraday, keeping the price below 95K for a long time, but the interest in selling above 100K remains unsatisfied until the end.

We still see the potential for the first cryptocurrency to rise into the 120K area once it overcomes resistance at 100k.

News Background

According to CoinShares, global investment in crypto funds rose to an all-time high of $3.851bn last week, renewing the record set two weeks ago. The positive trend continued for the ninth consecutive week. Bitcoin investments rose by $2.546 billion; Ethereum rose to an all-time high of $1.16 billion; XRP rose by a record $134 million; and Solana fell by $14 million.

MicroStrategy bought an additional 21,550 BTC for $2.1 billion at an average price of $98,783, founder Michael Saylor said. MicroStrategy now owns 423,650 BTC, purchased for $25.6 billion at an average price of $60,324 per coin.

Since 8 November, long-term investors have reduced their positions by 827,783 BTC (~$81.2 billion), which was only 30% offset by MicroStrategy and spot ETF purchases. The rest was bought up by short-term holders who are actively leveraged and vulnerable to falling quotes.

BlackRock highlighted Bitcoin’s potential as a new diversification tool alongside gold in its Global Outlook 2025. The limited supply of coins and growing investor demand drive BTC’s potential.

The FxPro Analyst Team