Market picture

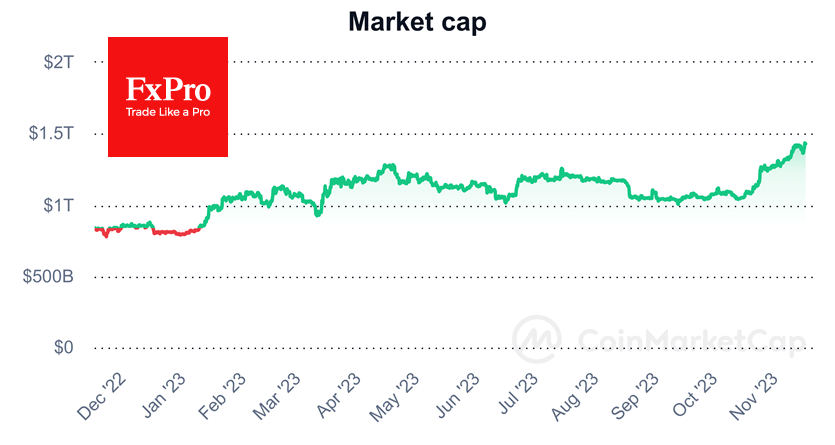

On Wednesday, the crypto market experienced a new growth spurt, rising 4.6% in 24 hours to $1.44 trillion, updating highs since May 2022. Bitcoin and several altcoins returned to the highs they tested a week earlier. Cardano (+11.11%) and Solana (+10.5%) led the growth among the leading coins.

Once again, the dynamics of crypto and equity markets have diverged. However, it should be noted that this seemingly negative correlation only works in the short term, as both asset classes have been rising steadily since October.

Bitcoin tested the $38K area again on Thursday morning. For now, it is not giving up. A move higher would renew the highs from May 2022, and it makes sense that the bulls would need a reason to break it up. However, the chances of further gains are higher than a reversal to the downside. If we accept that Tuesday’s decline was a correction, it has opened the way to $45-46K.

News background

The crypto market showed resilience in the third quarter, maintaining a steady pace of venture deals and investment volume despite a general downward trend in 2023, according to Binance Research. Venture capital funds invested the most in gamification projects, payment systems and trading platforms.

The US SEC filed 784 enforcement actions in fiscal 2023 and received $4.9 billion in penalties, of which $930 million was distributed to affected investors.

US financial conglomerate Citigroup announced the launch of an app that uses blockchain technology and smart contracts to support bilateral spot foreign exchange transactions.

Uniswap Labs released a cryptocurrency wallet app for Android. The tool allows users to exchange via a decentralised exchange directly within the app, eliminating the need for a separate browser extension.

According to Kaiko, Solana (SOL) has soared 520% in the last 12 months, ranking sixth in the cryptocurrency capitalisation league table. The Solana network developers’ partnership with Google, Circle and Amazon will increase the altcoin’s appeal. The increase in the number of DeFi protocols based on this blockchain will also help increase the value of the digital currency.

The FxPro Analyst Team