Market picture

Crypto market capitalisation fell to $1.04 trillion from $1.06 at the start of last week. The Crypto’s Fear and Greed Index briefly dipped into Fear territory at the end of the week but returned to Neutral (47) on Monday.

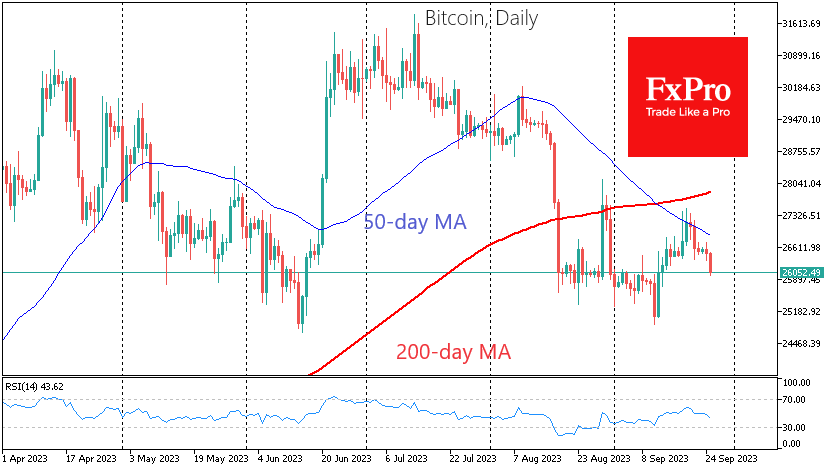

Bitcoin has been unable to break out of its sideways for a prolonged period. Trading at $26.1K at the start of Monday’s session, it’s down just 1.5% over the past 24 hours, 2% over the past seven days, and 0.5% from its level 30 days ago. The 50-day moving average remains active resistance. If the bearish momentum develops, we will closely monitor the dynamics around $25.8K, the previous consolidation area. A failure here could trigger a rapid decline to $25.8K. If the coin doesn’t get bought back here as well a direct path to $20K will open.

Ethereum is still unsuccessfully trying to find support and is trading below $1580. And this downtrend is revealing the general sentiment of market participants, where the risk appetite is diminishing. The move towards $1400 may have already begun.

News background

Anthony Scaramucci, founder of SkyBridge Capital, remains bullish on bitcoin. He believes that BTC has a much better future than gold, whose purchasing power has increased significantly over the past 50 years.

Bloomberg strategist Mike McGlone (Mike McGlone) warned that Bitcoin could fall because of the Federal Reserve’s actions. The Fed continues to pressure the crypto market by tightening monetary policy. The next support level for BTC is $25K.

According to JPMorgan, the April Shanghai update of the Ethereum network failed to meet expectations in terms of results and network activity. In addition, the crypto community had legitimate concerns about the level of network decentralisation.

Bitmain unveiled a powerful new Bitcoin mining machine. The Antminer S21 is highly energy efficient and supports a hash rate of 335 TH/s.

The FxPro Analyst Team