Market Overview

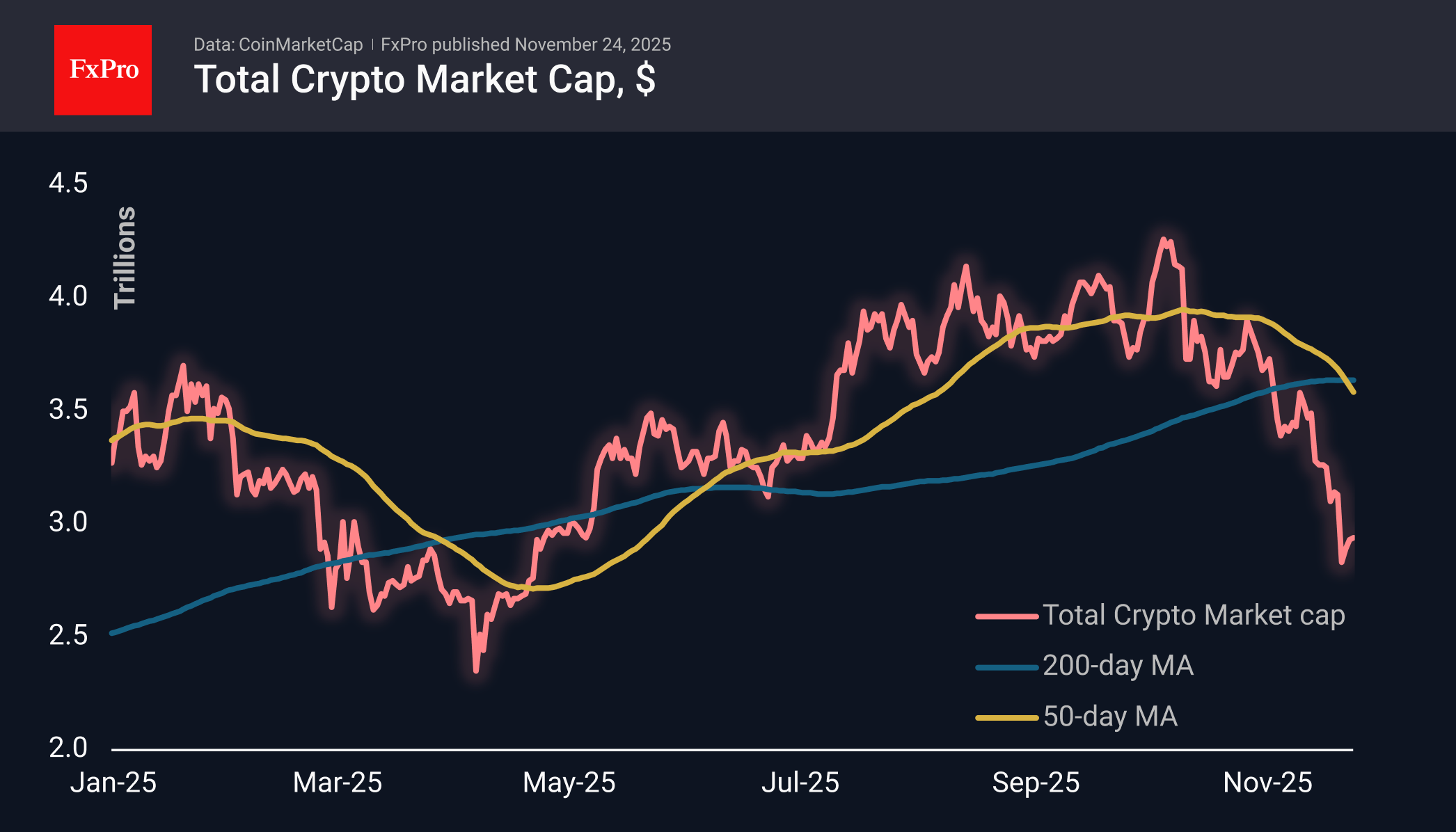

The crypto market appears to have found a foothold last Friday, adding 5% to its lows and recovering to $2.94 trillion. At the same time, the market is now more than 9% lower than it was seven days ago. This is a timid rebound after a devastating collapse. But in this situation, we can see some green shoots for the near future.

The sentiment index rose to 19, remaining in the territory of extreme fear but breaking out of the narrow range where it had been trading for ten days since November 13th. All this looks like a good, but short-term signal to buy in anticipation of a rebound after excessive overselling.

Bitcoin rose to $88K at the start of the day, then corrected to $86K during European trading. The first cryptocurrency slipped to $80.5K on Friday but found buyers to form a rebound, leaning on a recovery in risk appetite in stocks as the chances of a rate cut in December shot to 75% from 28%. BTCUSD received active support in the same $75-85K range in March and April, so it may linger there for some time.

News Background

Outflows from spot Bitcoin ETFs in the US have continued for the fourth consecutive week. According to SoSoValue, net outflows from spot BTC ETFs reached $1.22 billion last week. Total outflows over the five weeks amount to $5.13 billion, bringing the total cumulative inflows since the approval of Bitcoin ETFs in January 2024 to $57.64 billion.

Outflows from spot Ethereum ETFs in the US have continued for the third consecutive week, and for five out of the last six weeks. Net outflows from ETH ETFs totalled $500.3 million, reducing the total inflow since the ETFs’ launch in July 2024 to $12.63 billion. Over the past five weeks, investors have withdrawn $2.28 billion from ETFs.

Inflows into the recently launched Solana spot ETFs in the US have continued for four consecutive weeks. Net inflows rose to $120.2 million last week. Total inflows since the SOL ETF launched on 28 October have increased to $510.3 million (+33.5% over the week).

Inflows into the recently launched spot XRP ETFs in the US have continued for six consecutive trading sessions. During this time, investors have invested $422.7 million in the funds.

The options market is not yet signalling that Bitcoin has bottomed out and is pointing to the risks of a more profound decline, Glassnode notes. The total volume of bets on put options has reached 67.6%.

The volume of realised losses on Bitcoin has reached levels last seen during the collapse of the FTX crypto exchange, Glassnode notes. Experts have called this a sign of capitulation — a cleansing of the market of ‘weak hands’.

The market is entering the final phase of seller exhaustion, according to Swissblock. Bitcoin will remain under pressure unless there is a significant recovery in institutional or retail demand, according to an EgyHash analyst.

The FxPro Analyst Team