Market Picture

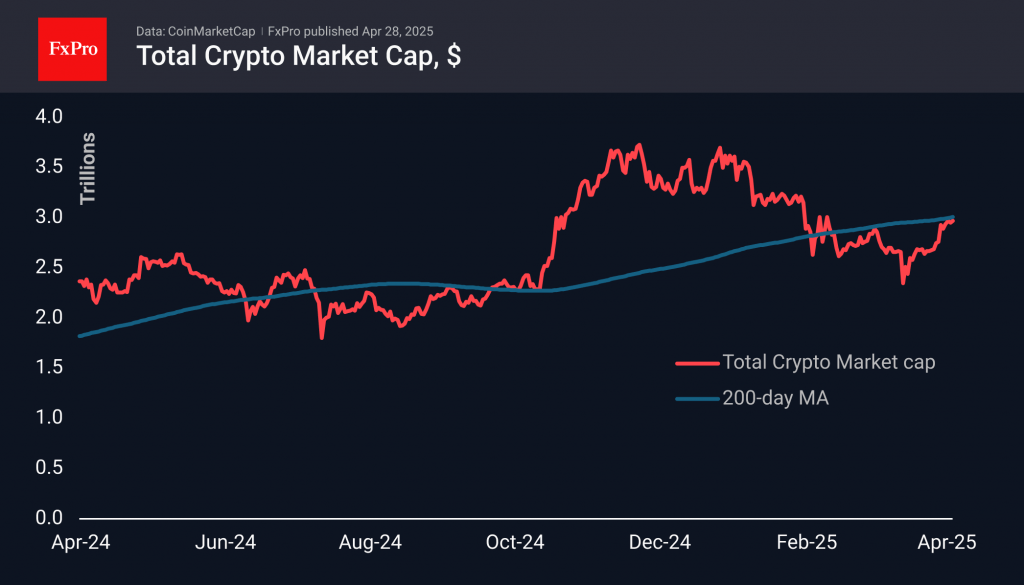

The crypto market capitalisation has been hovering around $2.97 trillion since the end of last week. The market has recovered to its 200-day moving average, but is hesitant to overcome it, as we see in the case of Bitcoin. The sentiment in the markets is neutral. It seems that players prefer to move upwards with relatively long stops.

Bitcoin is stabilising near $94,500, having fully recovered to the consolidation levels seen in February before its sharp decline. The technical outlook remains bullish, with BTCUSD trading above both its 50- and 200-day moving averages. Both indicators are trending upward, and last week’s consolidation above these levels marked a strong move, reinforcing the bullish momentum.

Ethereum is struggling with resistance in the form of the 50-day moving average near $1800 for the sixth day. Over the past couple of years, ETH has reacted strongly to movements around this curve: accelerating gains when breaking above it and facing significant pressure when falling below it. At the same time, there is a test of the resistance line of the descending channel, within which the movement has been going on since the second half of December.

News Background

QCP Capital noted that the bitcoin options market is currently dominated by call options with $95,000 strike prices for the end of April and May, suggesting that risk appetite remains strong. Meanwhile, President Trump softened his stance last week, reassuring investors about Fed Chairman Powell’s position and announcing plans to reduce tariffs on Chinese goods.

Bitcoin could rise to $2.4 million by the end of 2030 amid the growing adoption of the asset by institutions and sovereign wealth funds, ARK Invest forecasts in its bullish scenario. BTC will reach $1.2m in the baseline scenario and $500,000 in the bearish scenario. The analysis is based on calculations of the total target market (TAM), penetration rate and issuance of the first cryptocurrency.

The year 2025 could be a breakthrough year in institutional adoption of blockchain technology, with stablecoins being one of the drivers. Citigroup forecasts that their capitalisation by 2030 could grow to $1.6 trillion in a base case scenario and $3.7 trillion in a bullish scenario.

The US Federal Reserve announced the cancellation of guidelines that have deterred banks from dealing with digital assets. According to the statement, the regulator will stop requiring prior notification from financial institutions about plans or ongoing transactions with cryptocurrencies.

The FxPro Analyst Team