Market Picture

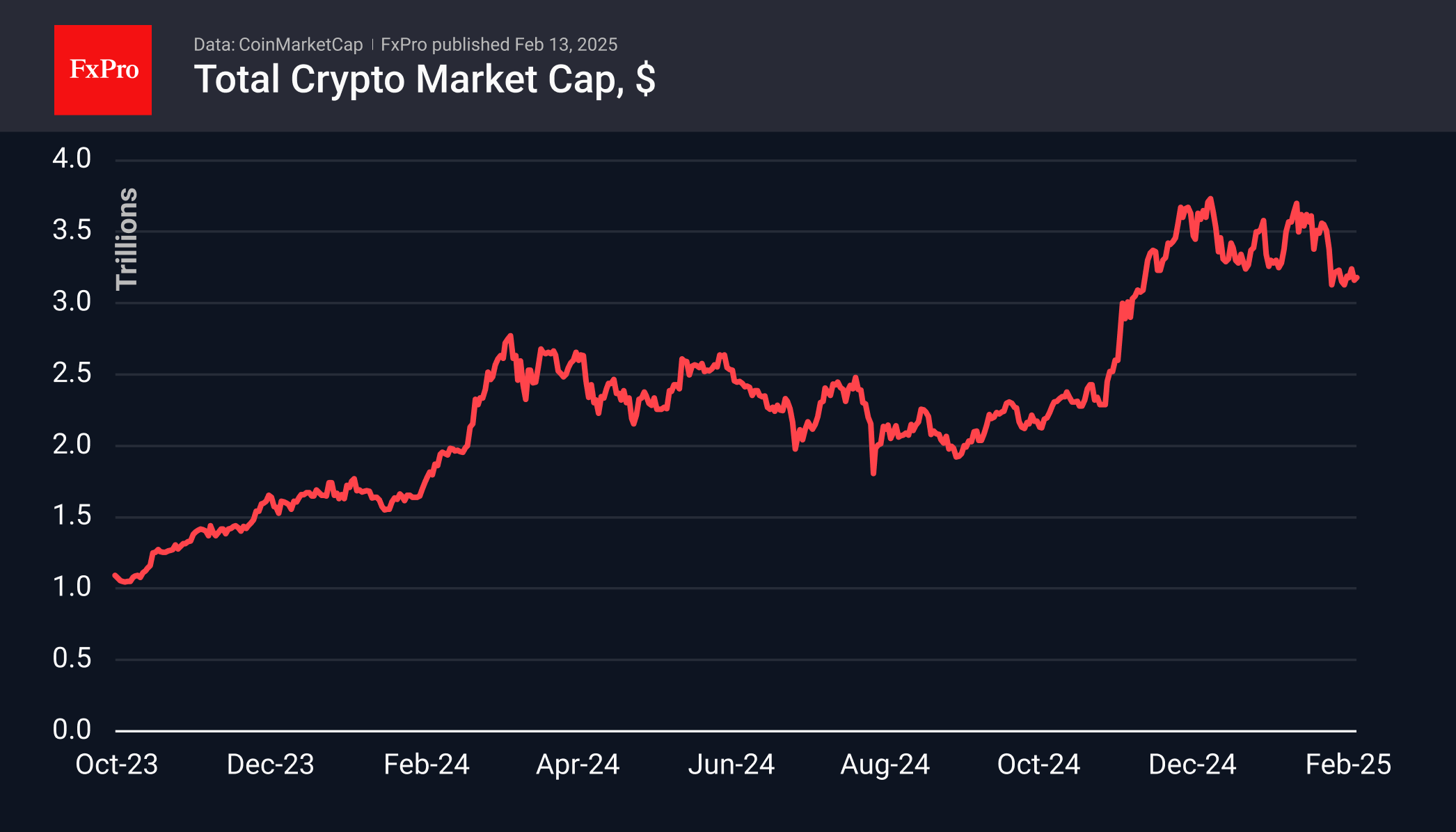

The cryptocurrency market has been stabilising at a lower level since early February. The $3.3 trillion capitalisation mark is acting as resistance, causing the market to reverse downwards quite swiftly. In December, this level served as support.

The Cryptocurrency Fear and Greed Index has risen to 50, trying to push off the local bottom.

Bitcoin is trading near 96,000, with the 50-day moving average acting as impenetrable resistance, halting growth since early February. Technically, this signals a deeper correction pattern, potentially extending down to 93,000. However, the prolonged consolidation remains a cause for concern.

Ethereum is trading the area from $2,500-2,700 after a more than 20% failure in early February. The major altcoin is trading below its 50- and 200-day moving averages, with things heading for a death cross when the fast average dips below the long average. The impressive inflows into ETFs have so far failed to turn the coin’s momentum around. Deep declines are being bought out, but it is not possible to confidently move to growth, as crypto enthusiasts have other favourites in this market cycle.

News Background

The Hash Ribbons indicator, which evaluates the state of the Bitcoin mining ecosystem, has signalled miner capitulation. According to CryptoQuant, this is expected to drive short-term growth for the leading cryptocurrency.

Altcoins did not react to Fed Chairman Jerome Powell’s statements about the lack of rush to adjust rates. Some experts saw this as a sign that the sector had passed the bottom.

Despite Bitcoin’s sharp correction early last week, the bulls remain largely in control. For altcoins, however, the price collapse was likely a bear market event, according to Glassnode. Altcoins have suffered one of the steepest declines in history, with their capitalisation dropping by $234 billion over the past two weeks.

Solana, not Ethereum, will prove to be the winner of the ‘tokenisation race’, said Anthony Scaramucci, founder of SkyBridge Capital. He justified his opinion by the lower fees and faster transactions in Solana.

The FxPro Analyst Team