Market picture

Bitcoin is trading near $16.8K on Wednesday morning, almost unchanged over 24 hours. The first cryptocurrency reaffirmed on Tuesday that it often acts as an indicator of financial market sentiment for the day. Its ability to halt the decline and record a slight rise was echoed later by crucial stock indices.

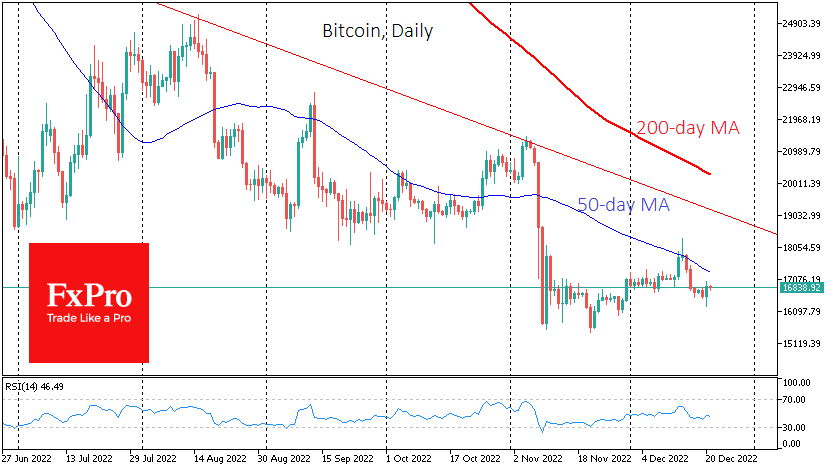

And that predictive ability is worrisome on Wednesday, as BTCUSD shows a slight downward bias, failing to build on Tuesday’s gains. Taking a step back, we can see that the crypto market remains in a prolonged consolidation. Investors often pick up liquidity during such periods, and strong moves usually follow.

After a strong sell-off lasting more than a year, conditions are forming for a reversal to the upside, as the RSI on the weekly charts forms a bullish divergence. The 50-day MA, downtrend and 200-day average lines have dipped to 17350, 19350 and 20300, making it easier for the bulls to convince the world of a reversal.

News background

According to the IntoTheBlock platform, the share of unprofitable bitcoin addresses increased to 52% after BTC fell below $17,000. Forty-four per cent of cryptocurrency holders are now in the breakeven zone.

The collapse of FTX will trigger a prolonged crisis in the blockchain industry, says Scott Minerd, founder of Guggenheim Partners. He says the crypto industry will experience turmoil comparable to the dot-com bubble in the late 1990s, leading to increased regulatory scrutiny.

The Bank of Canada has called for more careful oversight of stablecoins by regulators due to their risks to the international financial system. The central bank pointed to the intense concentration of stablecoins among their large holders, and the three largest stablecoins account for 90% of the coins in this crypto asset class.

The FxPro Analyst Team