Market Picture

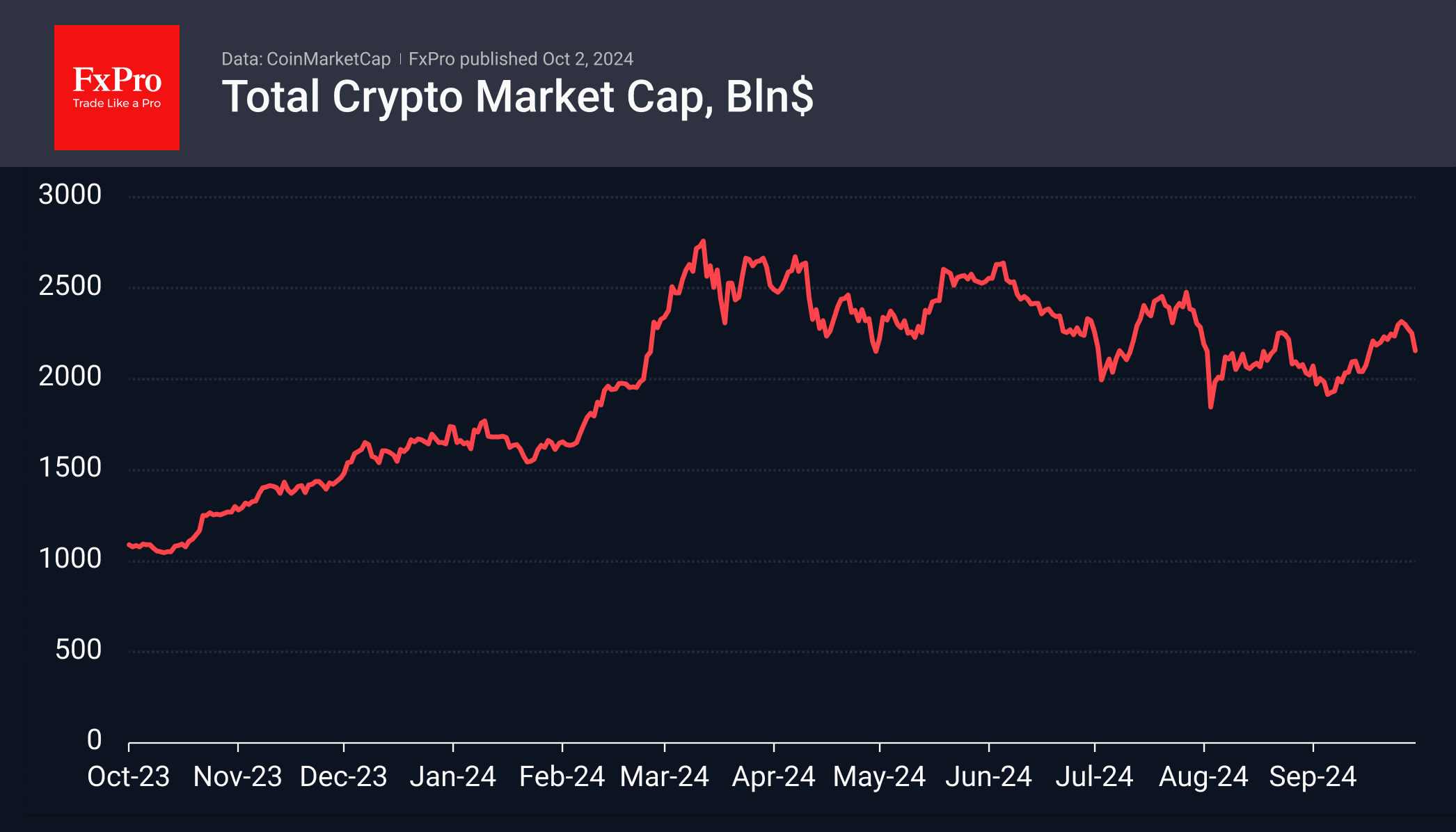

The crypto market lost 4.2% in the last 24 hours to $2.16 trillion, deepening a corrective pullback after rising to a two-month high of $2.30 trillion. This looks like a reaction to a flight from risk amid Iran’s missile attack on Israel. Cryptocurrencies took a hit along with risk assets, while the dollar, gold and oil rose sharply.

Bitcoin fell below $61K on Tuesday, losing around $3,000 (almost 5%). A technical factor added to the selling: the day before, BTCUSD had fallen below its 200-day moving average, reinforcing the exit of ‘weak hands’ from the asset. Bitcoin found local support as it approached its 50-day moving average just above $60.3K.

Geopolitics seem to have interfered with the bullish trade, pushing Bitcoin away from the upper boundary of the multi-month channel. However, it did manage to climb above the previous highs. Within this trend, a move towards the lower border would suggest a decline to the $52K area.

News Background

BTC rose 8% in September, bucking the seasonal trend and posting its best performance for the month since 2012. According to Coinglass data, positive Septembers in 2015, 2016 and 2023 led to positive closes in the following months into the new year.

JPMorgan believes that investing 1% of its assets in Bitcoin could be the best way to hedge the risks associated with the volatility of traditional asset classes such as stocks, bonds, and commodities.

Zach Bradford, CEO of mining company CleanSpark, expects Bitcoin to reach just under $200,000 within the next year and a half.

Ripple has entered the Middle East market for cross-border transfers. The company has received authorisation from the Dubai Financial Services Authority (DFSA) to operate in the United Arab Emirates (UAE).

94.5% of customers of the bankrupt FTX voted in favour of the platform’s reorganisation plan. The approval hearing will take place on 7 October. The FTX customer class claims assets worth $6.83 billion.

The FxPro Analyst Team