Market picture

The crypto market has lost almost 2% of its capitalisation in the last 24 hours to $2.51 trillion. Bitcoin is holding up better than the market, pulling back only 0.7% to $67.6K. Many top coins have deeper drawdowns. Ethereum loses almost 3%, BNB loses 1.6%, and Solana loses 2.6%. Meme coins are under fiercer pressure. With no meaningful drivers of its own, the crypto market has come under indirect pressure due to the stock market.

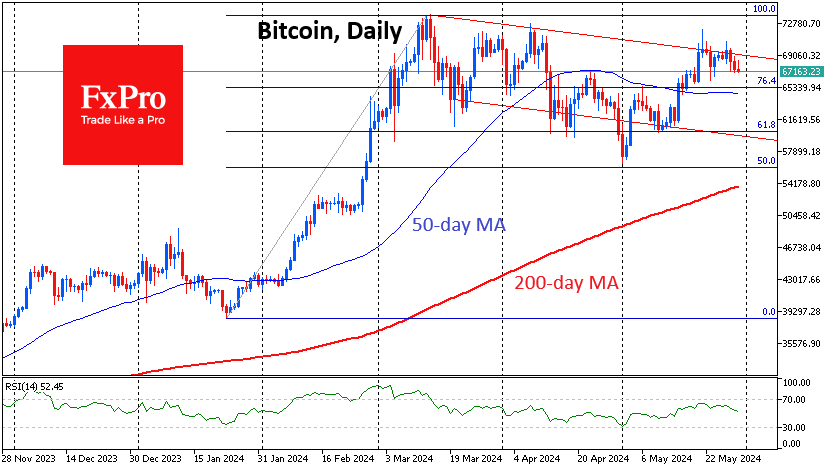

So far, there are more indications that Bitcoin is moving within a pullback scenario from the upper end of the range. In the most bearish scenario, the price could roll back to $60K. A more optimistic scenario suggests a decline to the $65K area, where the 50-day moving average lies.

Glassnode recorded signs of a recovery in buyer interest in Bitcoin. Long-term BTC holders (those holding the asset for more than 155 days) have resumed accumulation for the first time since December 2023 after months of selling.

News background

BlackRock’s spot bitcoin ETF outperformed Grayscale’s BTC-ETF (GBTC) in terms of assets under management. The Wall Street investment giant’s fund was the largest in the segment at $19.68bn, with total net inflows into US spot bitcoin-ETFs totalling $45.14m.

According to The Block, the gap in trading volumes on the Bitcoin and Ethereum spot market has narrowed to $1.3bn, a difference that was as high as $15bn in March.

The SEC has withdrawn its lawsuit against mining company Digital Licensing, also known as DEBT Box. A U.S. federal court ordered the regulator to pay about $1.8 million in case costs. In August 2023, the SEC accused DEBT Box of fraudulently raising $50 million in cash as well as unnamed amounts in BTC and ETH. In December, the court found that the agency’s lawyers had misled it in an attempt to block DEBT Box’s funds.

Payment giant Mastercard announced the pilot launch of its Crypto Credential service for cryptocurrency transfers between users (P2P transfers).

PayPal, the PYUSD issuer, has launched its stablecoin on the Solana network. The choice of SOL is due to the high speed and low fees of this blockchain.

The Grayscale survey showed that 47% of Americans are willing to allocate a share of their investment portfolio to cryptocurrency. At the end of last year, only 40% of respondents were going to invest in digital assets.

The FxPro Analyst Team