Market Overview

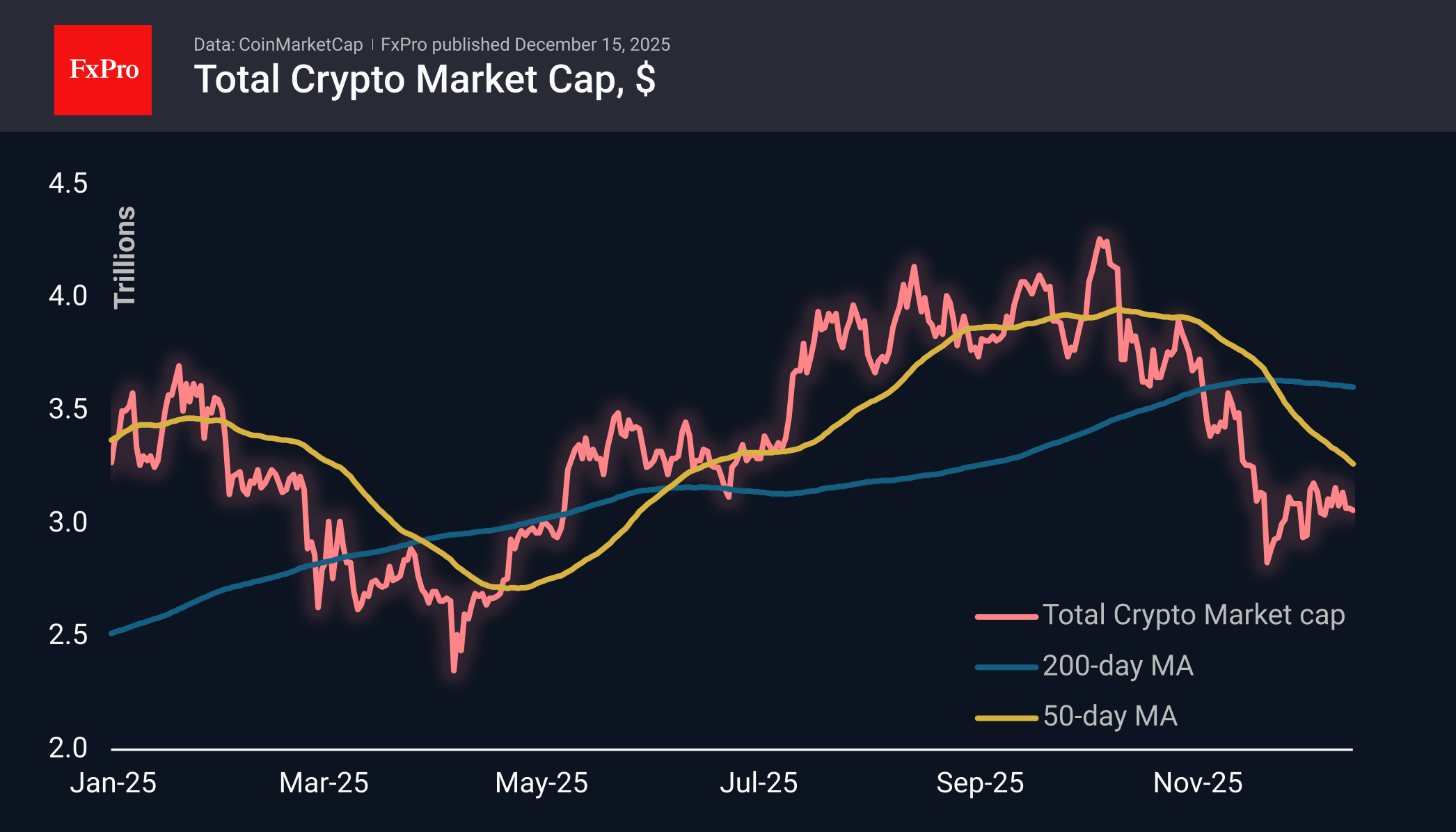

The crypto market capitalisation decreased by 0.2% in 24 hours and 2.2% in a week to $3.06 trillion. Overnight, the market managed to withstand the bears’ test of the $3.0T level, a level below which the bulls have not allowed it to settle for the last 10 days. At the same time, the transition from an upward trend to horizontal support is not the best signal for buyers.

The sentiment index has fallen to 16, its lowest level in almost three weeks. This return is another indication of the cyclical weakness of the crypto market. Without an obvious driver, as was the case in April, the market’s current prolonged stay in extreme fear is reminiscent of what we saw at the end of 2021.

Bitcoin slipped below $87.5K in early trading on Monday but is now recovering to levels close to $90K. Selling pressure since the end of last week has broken the upward trend that had been forming since the end of November. Now, the formal baseline scenario is a return to $81K. However, bulls still have some hope for a more protracted consolidation and subsequent growth, rather than an immediate sell-off.

News Background

According to SoSoValue, net inflows into spot BTC ETFs amounted to $286.6 million, the highest in the last seven weeks. Total inflows since the approval of Bitcoin ETFs in January 2024 have increased to $57.90 billion. Net inflows into spot Ethereum ETFs in the US amounted to $208.9 million for the week, bringing the cumulative net inflows since the ETF’s launch in July 2024 to $12.88 billion. Inflows into the recently launched spot Solana ETFs in the US totalled $36 million for the week, continuing for all seven weeks since their launch, amounting to $675 million. Inflows into the spot XRP ETFs, launched on November 14 in the US, have continued for almost a month and exceeded $974 million.

The total capitalisation of the crypto market has fallen by 15% in 30 days, indicating that it is entering a phase of deep correction, according to Binance Research. December is considered less liquid than other months, and market volatility is likely to increase.

Bitcoin is expected to close the year below the psychological mark of $100,000, according to the majority of users on the Kalshi prediction platform, where the chances of exceeding this mark are only 23%.

Large companies, governments, centralised exchanges and investment funds have concentrated 29.8% of the total volume of bitcoins in free circulation, according to Glassnode’s calculations.

The first cryptocurrency should be viewed more as a speculative collectable than a working asset, according to Vanguard. Bitcoin does not have the properties that provide income, compound interest, and cash flow.

International rating agency Moody’s has published a set of criteria for determining the credit rating of fiat-pegged stablecoins. Some experts believe that Tether’s USDT is in the crosshairs. In November, S&P Global downgraded USDT’s stability rating to the fifth-lowest level.

The FxPro Analyst Team