Market picture

The price of bitcoin and the capitalisation of the entire crypto market have fluctuated in a very narrow range since the second half of Friday, with the centre of gravity around $22.3K and $1.03T, respectively.

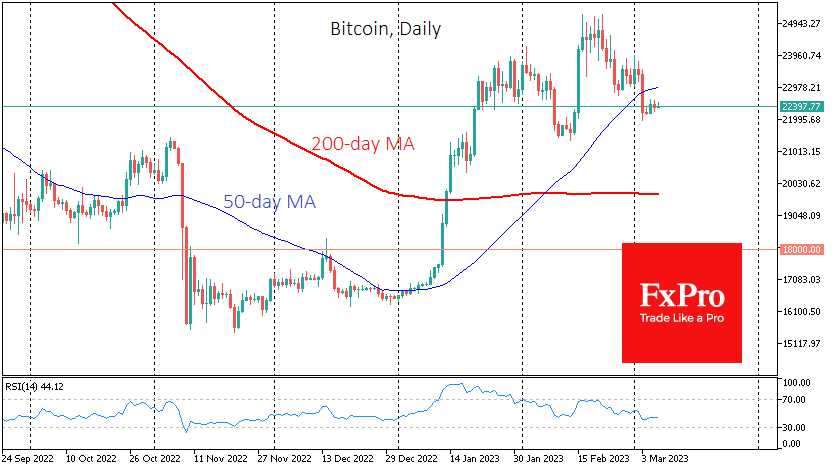

For Bitcoin, however, things are looking a little more positive. A closer inspection reveals a slight upward bias in these calm waters. There is some upward tilt after last week’s notable drop, which resembles Whale’s style. At the same time, there is not enough positive news in the background for prices to rise.

The technical picture in the larger timeframes is also bearish so far, as BTCUSD has dropped below its 50-day moving average in a strong move and is making no attempt to climb higher while remaining below its 50- and 200-week MAs.

Ethereum’s daily chart shows a similar pattern with moves between the 50- and 200-day MAs, but with the digital silver mainly trading between $1530 and $1670 for the eighth week in a row.

News Background

According to CoinShares, investments in crypto funds fell by $17 million last week, the fourth consecutive week of outflows— investments in Bitcoin funds fell $20 million, while Ethereum rose by $0.7 million. Investments in funds that allow shorting bitcoin increased by $2 million.

US cryptocurrency exchange Kraken confirmed its intention to open its bank, despite a challenging regulatory environment and demands from regulators.

BCB Group announced its intention to fill the void left by the closure of Silvergate Exchange Network (SEN) by allowing crypto market participants to conduct unrestricted transactions in US dollars.

Investment in DeFi projects increased by 190% to $2.71 billion in 2022, according to CoinGecko. Investor interest in CeFi fell almost fourfold year-on-year to $4.39bn.

The FxPro Analyst Team