Market Overview

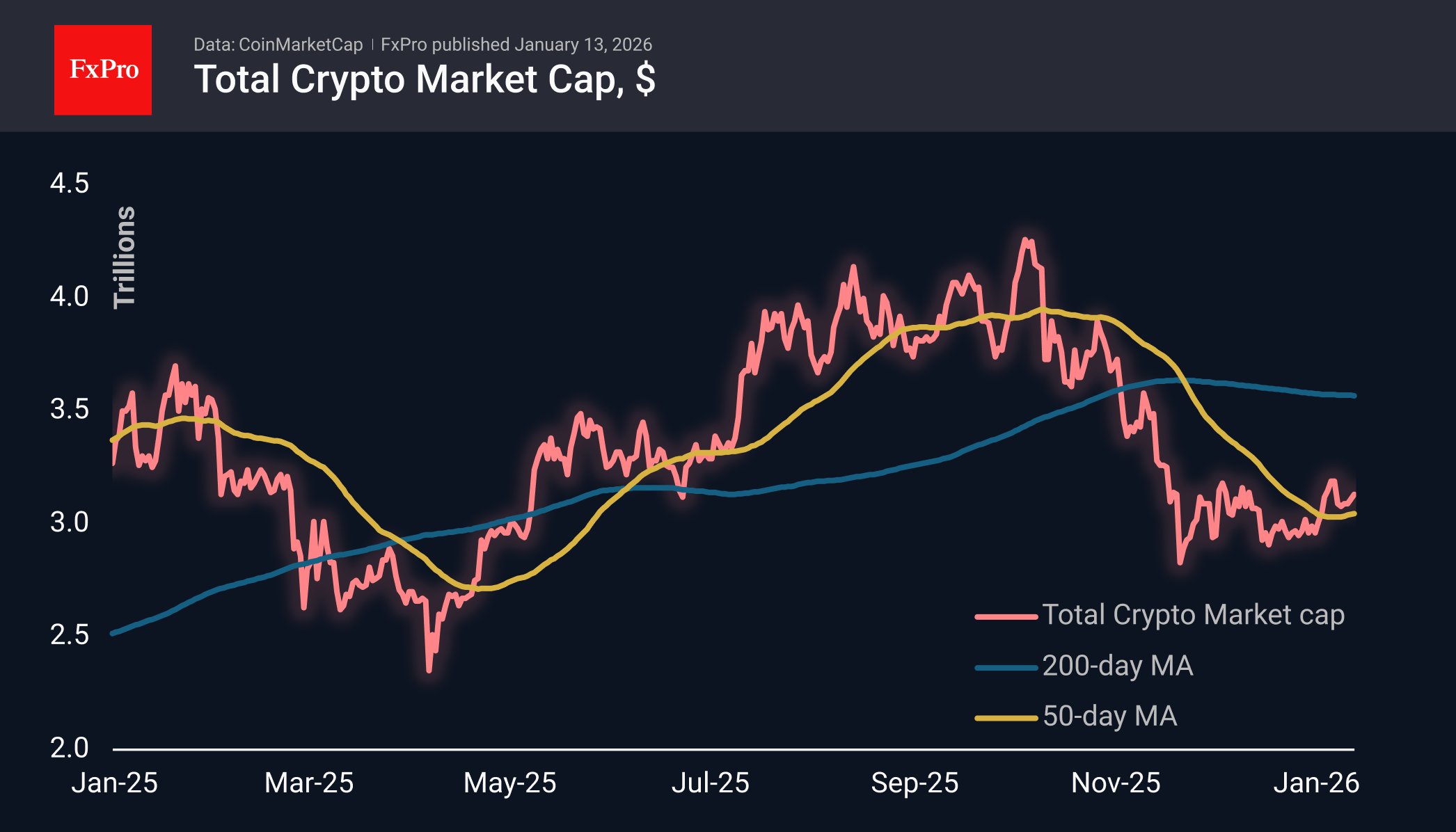

The crypto market gained 0.75% over the past 24 hours to $3.13T in another attempt to turn towards growth, pushing off the 50-day moving average. Appetite for crypto grew amid a rebound in US financial markets during Monday’s trading and continued growth in Japanese stocks on Tuesday morning. Steady risk appetite began to spread to cryptocurrencies, which had underperformed the market for many weeks.

Bitcoin has exceeded $92K since Monday evening, attempting to climb above levels seen a week ago. There were wide fluctuations on Monday, with an impressive increase in sales when the price rose above $92K, but this did not deter the bulls from continuing their attempts. It would be too hasty to conclude sustained risk appetite while the price remains below previous local highs of $95K. An optimistic view of the situation considers a series of rising local lows since November.

Ethereum is holding above $3,000, carefully forming a bottom at this level over the past five days. At the end of last month, a similar support level was near $2,920. As with Bitcoin, ETH is trading above the 50-day MA, but still below the local peak on 6 January.

News Background

Retail investors continue to offload loss-making assets due to fears of volatility, which is increasing selling pressure, according to CryptoQuant.

Profit-taking and shifting expectations in the options market indicate that investors are postponing bullish expectations to a later date, not believing in a quick rally. Optimism about a breakout in the first quarter is fading, QCP Capital notes.

Views of cryptocurrency content on YouTube have fallen to their lowest levels since 2021, ITC Crypto notes. A similar decline in social interest has also been recorded on social network X.

According to Arkham Intelligence, the DAT company BitMine has increased the amount of locked assets on the Ethereum network to 1.08 million coins. The value of the portfolio exceeded $3 billion.

The theory of Ethereum’s ‘demise,’ based on its prolonged decline against Bitcoin, is untenable, said MN Trading founder Michael van de Poppe. In his opinion, the ETH/BTC rate has already bottomed out. The key argument in favour of growth is the increase in the volume of stablecoins on the Ethereum network.

South Korea has lifted its ban on corporate investment in cryptocurrencies. Legal entities will be able to allocate up to 5% of their share capital to coins from the top 20 by market capitalisation, excluding stablecoins.

The FxPro Analyst Team