Market picture

Crypto market capitalisation exceeds $1.07 trillion (+0.6% in 24h), maintaining its upward trend over the last seven days.

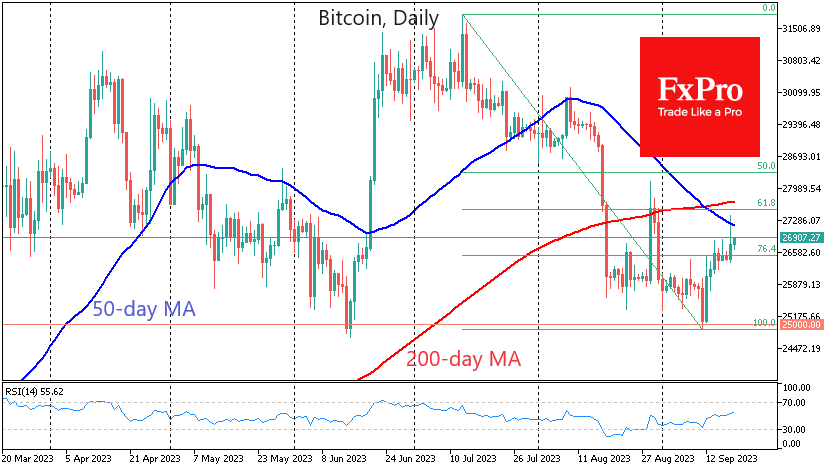

Bitcoin hit $27.4K on Monday for the first time since late August but quickly pulled back to $26.8K. This was the second failed attempt to break above the 50-day moving average since early August and the second downward reversal on the approach to the 200-day MA. This is an important signal that the bears are still in control of the situation in the largest cryptocurrency, even though they gave some space to “play” as we expected yesterday.

Ethereum, unlike the first crypto, is moving strictly to the right, almost pegged to $1640. The long consolidation removes oversold conditions and prepares liquidity for a new round of declines. However, much for the two largest cryptos this week depends on big central banks comments, from the Fed to the Bank of Japan. They can either bring back risk appetite or completely undermine it.

News background

According to CoinShares, investments in crypto funds decreased by $54M last week, with outflows for 8 of the previous nine weeks. Bitcoin investments decreased by $45M, Ethereum investments fell by $5M, and acquisitions in funds that allow shorting Bitcoin fell by $4M.

Weekly trading volume rose to $1 billion, up 42% over the previous week. Cumulative outflows over the past two months totalled $455 million, with net inflows since the beginning of the year down to just $51 million, CoinShares noted.

Central and South Asian countries are leading the way in terms of cryptocurrency adoption, according to research from Chainalysis. India topped the list, with Nigeria and Vietnam rounding out the top three. The global index of mass adoption of cryptocurrencies is still very far from the historic highs of 2021 and shows a downward trend.

Ethereum developers failed to launch the Holesky test network and scheduled a new attempt in two weeks. The failure was due to a misconfiguration in the Genesis source file.

The FxPro Analyst Team