Market picture

The crypto market cap has risen over 7.3% in the last 24 hours to $1.25 trillion. It is the highest valuation since April when fears over the safety of money in the regional banks drove the influx. The formal reason was further speculation around the launch of a spot ETF on Bitcoin. At the same time, the liquidation of short positions intensified the amplitude, as the wave of triggered orders came at a time of low market liquidity.

Bitcoin opened Tuesday with a jump to $35.2K, a level not seen since May 2022. The first cryptocurrency’s dominance index exceeded 52%, the highest since April 2021.

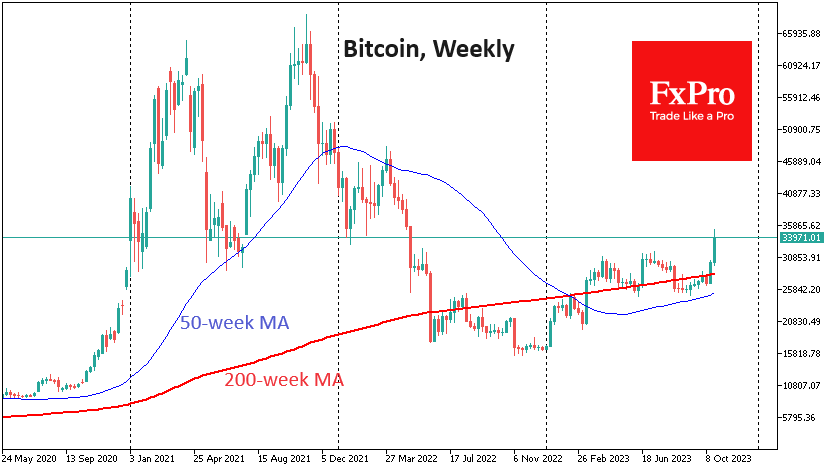

The technical picture points to a long-awaited exit from consolidation and a rapid start to growth. The first cryptocurrency found systematic support in early October at the 50-day moving average. It overcame this with a sharp move at the beginning of last week and then held above the 200-day. Now, it is gaining strength in the area above the 200-week, where long-term holders can join the buying.

The $31K to $46K range is an area of thin air, with not many obstacles. The market blew it down quickly last year, and it is worth being ready to mirror the move this time around.

News Background

According to CoinShares, investments in crypto funds rose by $66 million last week, the fourth consecutive week of inflows. Bitcoin investments increased by $55 million, while Ethereum investments decreased by $7.4 million. Investment in Solana increased by $15.5 million, significantly outperforming all altcoins.

Anticipating the approval of spot bitcoin ETFs stimulates further inflows into the first cryptocurrency. However, the investments are relatively small compared to June, when Blackrock filed its ETF application with the SEC, suggesting that investors are more cautious this time, CoinShares noted.

Bernstein said that the SEC’s approval of the Bitcoin ETF could act as a powerful catalyst for the start of a new bull cycle in the cryptocurrency market. For the first time in the history of cryptocurrencies, institutional investors have a chance to enter the market before the massive hype begins.

Accounting firm Ernst & Young points to the substantial institutional demand for Bitcoin-based financial instruments. Large organisations are ready to invest “trillions of dollars” in SEC-registered crypto products.

One of the developers of the Lightning Network discovered a vulnerability in the Bitcoin scaling solution that could have compromised the funds transfer. The vulnerability has now been fixed.

The FxPro Analyst Team