Market Picture

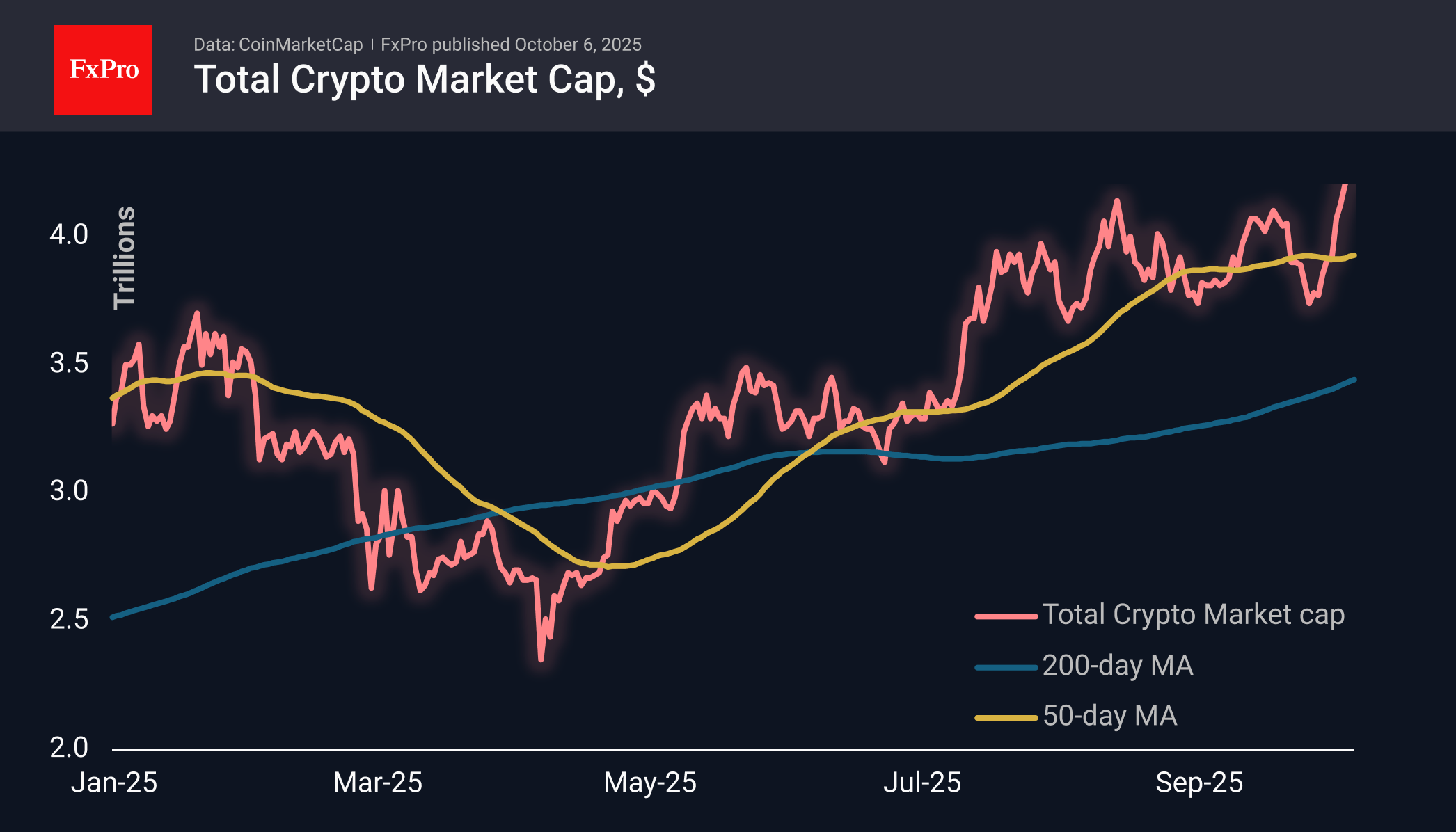

The crypto market cap hit a new record high on late Sunday, rising to $4.27 trillion. On Monday, the market retreated slightly from its highs to $4.24 trillion but still recorded a 1.4% increase over the past 24 hours. This was due to the steady rise of BTC, which pushed it to new all-time highs.

The sentiment index rose to 71, reaching 74 (greed) on Sunday, showing the highest values since mid-August, when we saw a similar surge in Bitcoin.

Bitcoin set a new all-time high of $125.6k, correcting to $123.6k by the start of active trading in Europe. Over seven days, BTCUSD gained over 15%, but we must consider the reduced liquidity on Sunday, which fuels the amplitude of the movement. There was a similar pattern in July and August, when a sharp increase followed the update of highs at approximately these levels in sales.

However, there are also differences from previous months. In July, XRP saw strong growth, in August, it was Ethereum, and in September, Solana made a significant leap. However, there was a clear winner all this time — BNB, which has been updating its historical highs for the fourth month in a row, shooting up 20% in seven days and 40% in 30 days, with a new record of $1,220 set on Monday.

News Background

One of the likely reasons for the growth of cryptocurrencies in the last week was the suspension of the US government’s work on 1 October. Earlier, during three of the last five shutdowns, there was also an increase in Bitcoin, as traders fear a fall in the value of fiat currencies, which also plays into the hands of gold and stocks.

According to SoSoValue, net weekly inflows into spot BTC ETFs amounted to $3.24 billion, the highest since November last year and the second highest in history. Total inflows since the approval of Bitcoin ETFs in January 2024 have increased to $60.05 billion.

The net weekly inflow into ETH ETFs was $1.30 billion, the highest in the last seven weeks. Total net inflows since the launch of ETFs in July 2024 have grown to $14.42 billion.

According to Glassnode, the total balance of Bitcoin on exchanges has fallen to a six-year low of 2.83 million coins. In 30 days, almost 170,000 BTC were withdrawn from trading platforms. VanEck believes that the ‘first official deficit’ could occur as early as Monday.

As a result of the latest recalculation, the difficulty of mining Bitcoin has increased by 5.9%, setting a record of 150.8 T. According to BitcoinMiningStock, public mining companies have increased their share of total computing power to 39.8%.

The FxPro Analyst Team