Market picture

The crypto market is cooling after a surge in buying on the 29th, losing 0.8% over the past 24 hours to $1.085 trillion, but still almost 4% higher than before the jump. Crypto Fear and Greed Index has returned to neutral territory after a week and a half of wandering in “Fear”.

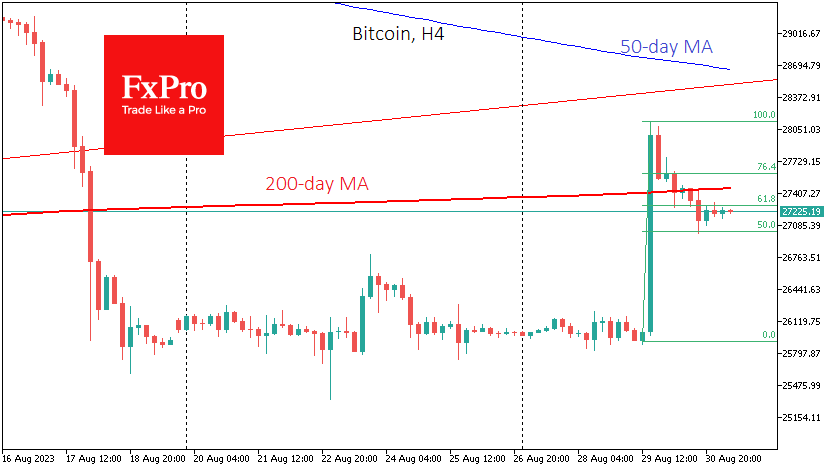

Bitcoin briefly dipped to $27K on Wednesday, about half of its initial jump from $26K to $28K and back below its 200-day and 200-week averages, despite the increased traction of risk in traditional markets. From the looks of it, the decisive trend battle won’t come until Friday evening at the earliest, with consolidation around current levels all the way through.

XRP has performed worse than the cryptocurrency market over the past few days, having erased almost all gains of its latest leap. On a weekly timeframe, long-term support appears to have been taken over by the 200-week average (now $0.516). A fortnight ago, the sell-off stopped at the 50-week average ($0.457). Both curves are well above the multi-year uptrend line, which now runs through $0.39. This dynamic could attract more speculators soon, with an upside potential of $0.60 or even $0.80.

News Background

According to Raul Pal, founder of Real Vision, ongoing Bitcoin consolidation could well end with a powerful spike. According to him, BTC is growing exponentially after periods of low volatility.

Bloomberg Intelligence suggests that stablecoins will be more popular than BTC in the short term.

Company X, formerly known as Twitter, has obtained the necessary licence to provide cryptocurrency payment and trading services in the US. This is a positive sign for the future of crypto on the platform.

BlackRock has invested over $400 million in the shares of four mining companies, making it one of the largest lobbyists for the Bitcoin industry in the US.

During the SEC’s case against Binance, the regulator filed a sealed motion containing 35 exhibits, a statement from the agency’s trial counsel and a proposed order. The commission did not want the data submitted to the court to be made public, a rare occurrence according to legal experts.

The US Congress has proposed firing the head of the SEC following a court ruling that found Grayscale’s refusal to create a bitcoin ETF illegal.

The FxPro Analyst Team