Market Picture

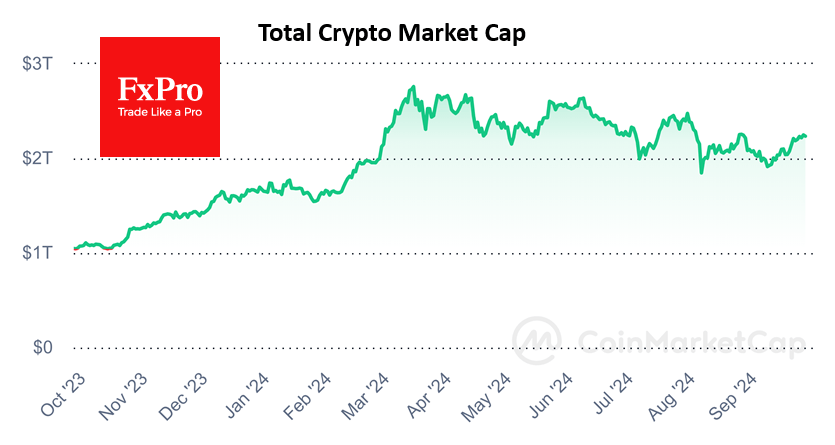

While stock indices are hitting multi-month or all-time highs, the cryptocurrency market is treading water at a one-month high, having lost 0.45% in the last 24 hours. Given the positive dynamics of global equity markets and the nature of recent gains, the latest pullback looks like a consolidation of forces before a possible further spurt. Additionally, the strengthening dollar has also put pressure on cryptocurrencies.

Bitcoin has so far failed to consolidate above the 200-day moving average. In the morning, the price pulled back on stop orders in low liquidity to $62.7K but then added $1K at the time of writing. This has become a typical deviation from the extremes in recent days. For the past week, Bitcoin has been forming a sideways channel just under $2K wide with a slight upward bias that now runs through $62.7K-$64.5K. A move beyond it could launch a medium-term trend after the current lull.

News Background

Bitfinex believes Bitcoin’s September rally was mainly driven by activity in derivatives trading amid weak demand in the spot market. BTC needs to consolidate above the August high of $65,200 to continue its rally.

Bitcoin is mistakenly regarded as a risky asset because of its frequent correlation with the stock market, said Robert Mitchnik, head of BlackRock’s crypto division. In his view, BTC is a ‘scarce, global, decentralised asset that is not tied to any particular country and lacks traditional counterparty risk.’

The US SEC has delayed a decision on Nasdaq’s proposal to list options on spot Ethereum-ETFs from BlackRock and Bitwise until 10 November.

The SEC entered into a settlement agreement with TrueCoin and TrustToken. The companies will pay a $500,000 fine for illegally offering investment contracts in the form of TrueUSD (TUSD) stablecoin.

The court sentenced former Alameda Research head Caroline Ellison to two years in prison and forfeiture of $11bn on fraud and money laundering charges.

BNY Mellon, the world’s largest custodian bank, plans to enter the custodial market for bitcoin and Ethereum-based spot ETFs. Bloomberg noted that such a move would threaten Coinbase’s dominant position.

The team of trading Telegram bot Banana Gun confirmed its intention to reimburse 11 affected users for the $3 million stolen in the hack on 19 September.

The FxPro Analyst Team