Market Picture

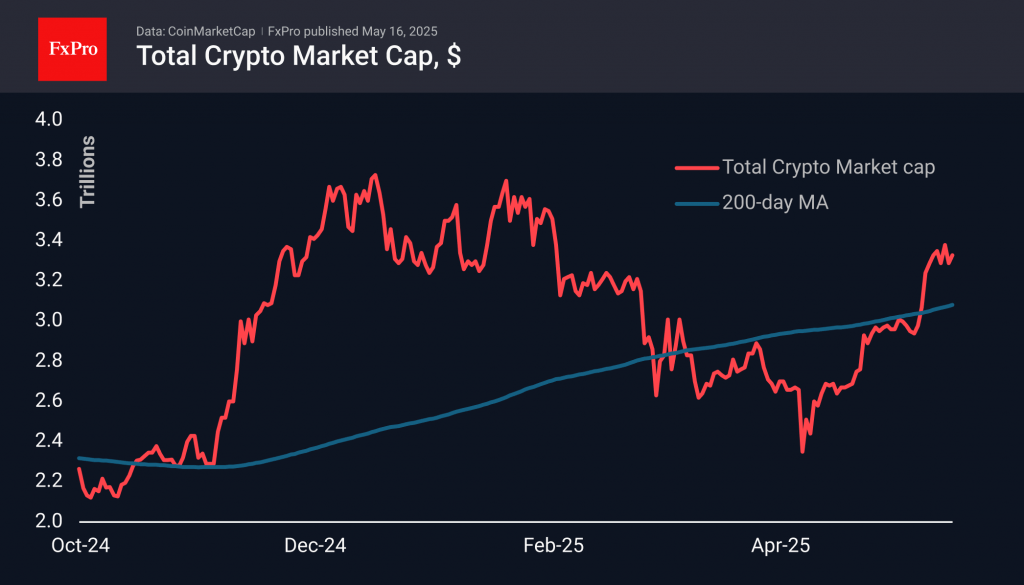

Over the past seven days, the cryptocurrency market has ranged between $3.26 trillion and $3.30 trillion, reaching $3.33 trillion as of writing after recovering from the lower end of the range. Among the leading cryptocurrencies over the past day are EOS (+11.7%) and Aave (+8.5%). Among the outsiders are XPR and Monero, which showed a decline of 1%.

Bitcoin rose 2% over the last day, holding the $104K as a key level. The positive factor is that sellers have not yet managed to seize control of the market. However, resilience at high levels may be temporary before the next bounce, and there is considerable pressure near the upper boundary of the current range. In other words, the short-term outlook suggests a decline from current levels.

News Background

According to Deribit data, BTC options are balanced, while put options on Ethereum have a slight bias.

According to TradingView, bitcoin miners have almost stopped selling their holdings of the first cryptocurrency in recent weeks, preferring to accumulate coins on their balance sheet. This shift from selling to hoarding could be an important factor for the cryptocurrency market.

According to Dune, a week after the major Pectra upgrade was implemented, the number of smart account authorisations for EIP-7702 exceeded 11,000. This indicates high interest in the new features from exchanges, wallets, and decentralised apps.

The FxPro Analyst Team