Market Overview

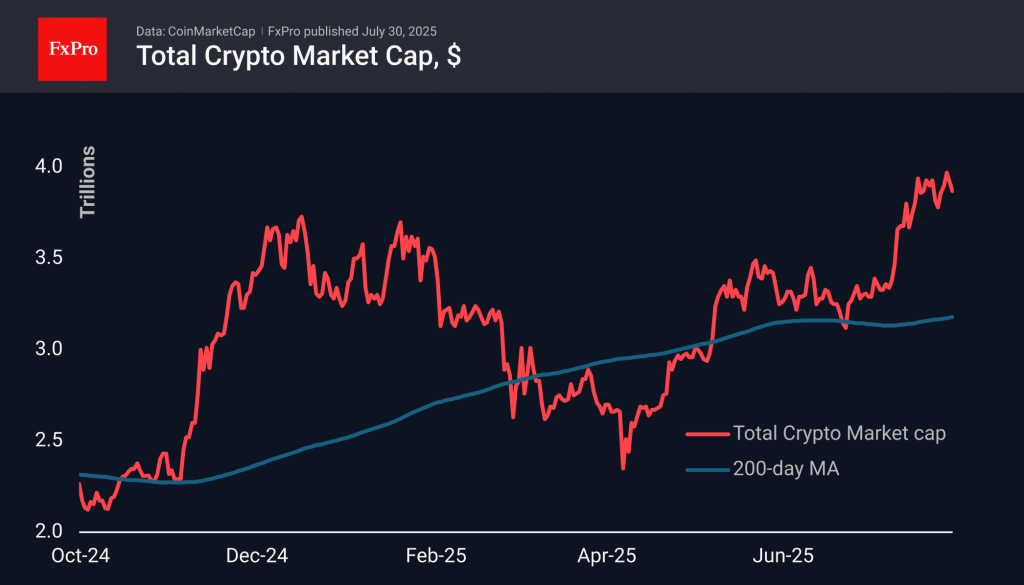

The crypto market cap has retreated another 0.7% over the last day to $3.87 trillion, maintaining a cautious stance ahead of an extremely busy second half of the week in terms of macroeconomic news. This impact is the result of the cryptocurrency market being saturated with institutional players who play by the usual rules.

Bitcoin fell below $117K at the end of Tuesday, but it returned above $118.2k during the European session and is moving higher. However, the dynamics of recent days also indicate impressive selling pressure as it approaches $119K. The upcoming Fed meeting has sufficient potential to disrupt this lull. At the same time, it is important to be prepared for false breakouts and not to rush to conclusions about the direction until the price consolidates outside the $116-120K range.

News Background

According to Coindesk analyst Omkar Godbole, the Coinbase premium has turned negative for the first time since May. The institutional demand indicator points to a decline in interest in Bitcoin in the US and a possible correction in the market. Prior to this, the premium had remained positive for more than 60 consecutive days, a record.

Bridgewater Associates founder Ray Dalio advised investors to allocate at least 15% of their portfolio to gold and Bitcoin to protect themselves from the economic risks posed by the stock and bond markets. This is the optimal risk/return ratio against the backdrop of growing US national debt and currency depreciation.

The largest US miner, MARA Holdings, raised nearly $1 billion to purchase Bitcoin. Over the year, MARA’s reserves increased to 50,000 BTC; the company is the second-largest corporate holder of Bitcoin after Strategy.

Tron Inc. (formerly SRM Entertainment) has applied with the SEC to issue shares, debt instruments and other securities worth up to $1 billion. The company will use these funds to expand its reserve in TRX tokens.

The FxPro Analyst Team