Market Picture

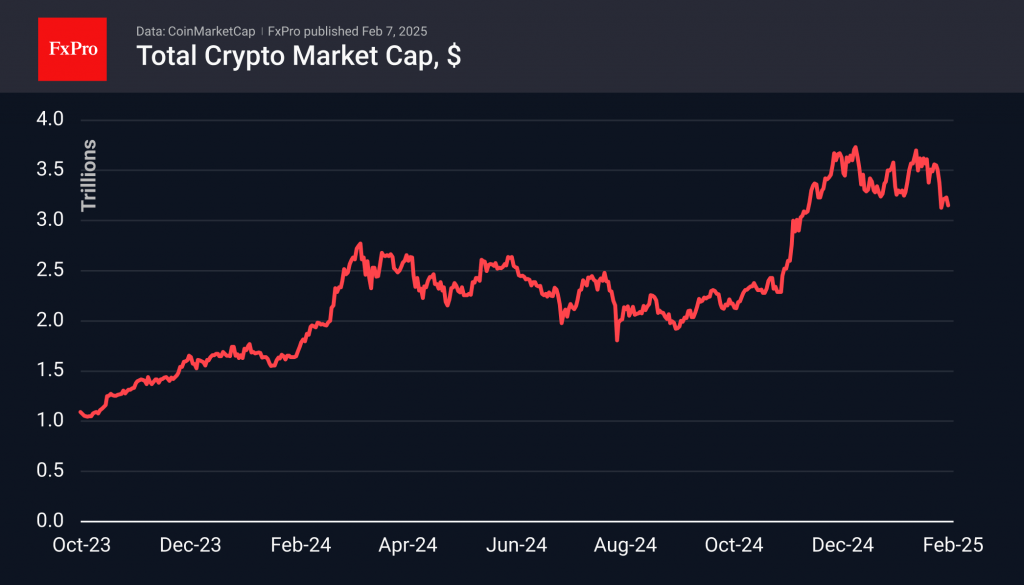

The cryptocurrency market has decreased by more than 11% over the past seven days. The primary impact for bearish investors occurred over the weekend and on Monday following the imposition of US tariffs against Canada, Mexico, and China. Despite an initial rally, the market continued its decline, reaching a value of 3.15 trillion, which represents a dip below the previous cyclical low.

A similar pattern was observed in March of last year when the market experienced a prolonged and somewhat alarming sideways slump. The crypto market sentiment indices accurately reflected this mood, demonstrating a shift back into fear territory by the end of the week.

Current conditions are relatively favourable for bitcoin. Although the leading cryptocurrency has also declined, it has done so at a slower rate compared to the overall market, losing slightly more than 6% over the seven-day period. Bitcoin’s price has fallen below $97K and is now trading beneath its 50-day moving average. Consolidation below this level indicates a potential disruption of the uptrend, with a pullback to the 200-day moving average, near $80K, considered a possible target.

News Background

Arthur Hayes forecasts that Bitcoin will return to the $70K-$75K range. The Former BitMEX head said the driver of the decline would be the realisation that the current US president’s policies are virtually the same as those of his predecessors. He believes the creation of a US Special Bitcoin Reserve (SBR) could be a “net negative” for the industry as digital gold becomes a “political weapon. “

Ethereum’s share of the total crypto market capitalisation has fallen to its lowest level in four years. JPMorgan said ETH will continue to face “intense competition” from Solana and Layer 2 (L2) solutions with lower fees and higher performance.

If Ethereum holds $2500, it could “bounce to $4000 or even $6000,” predicts tech analyst Ali Martinez. If the $2500 level is breached, the next target will be $1700. Martinez noted that capital continues to flow from Bitcoin and Ethereum into stablecoins.

According to a JPMorgan survey of 4,200 of the bank’s global clients, 71% of institutional investors do not plan to trade cryptocurrencies in 2025.

The FxPro Analyst Team