Market Overview

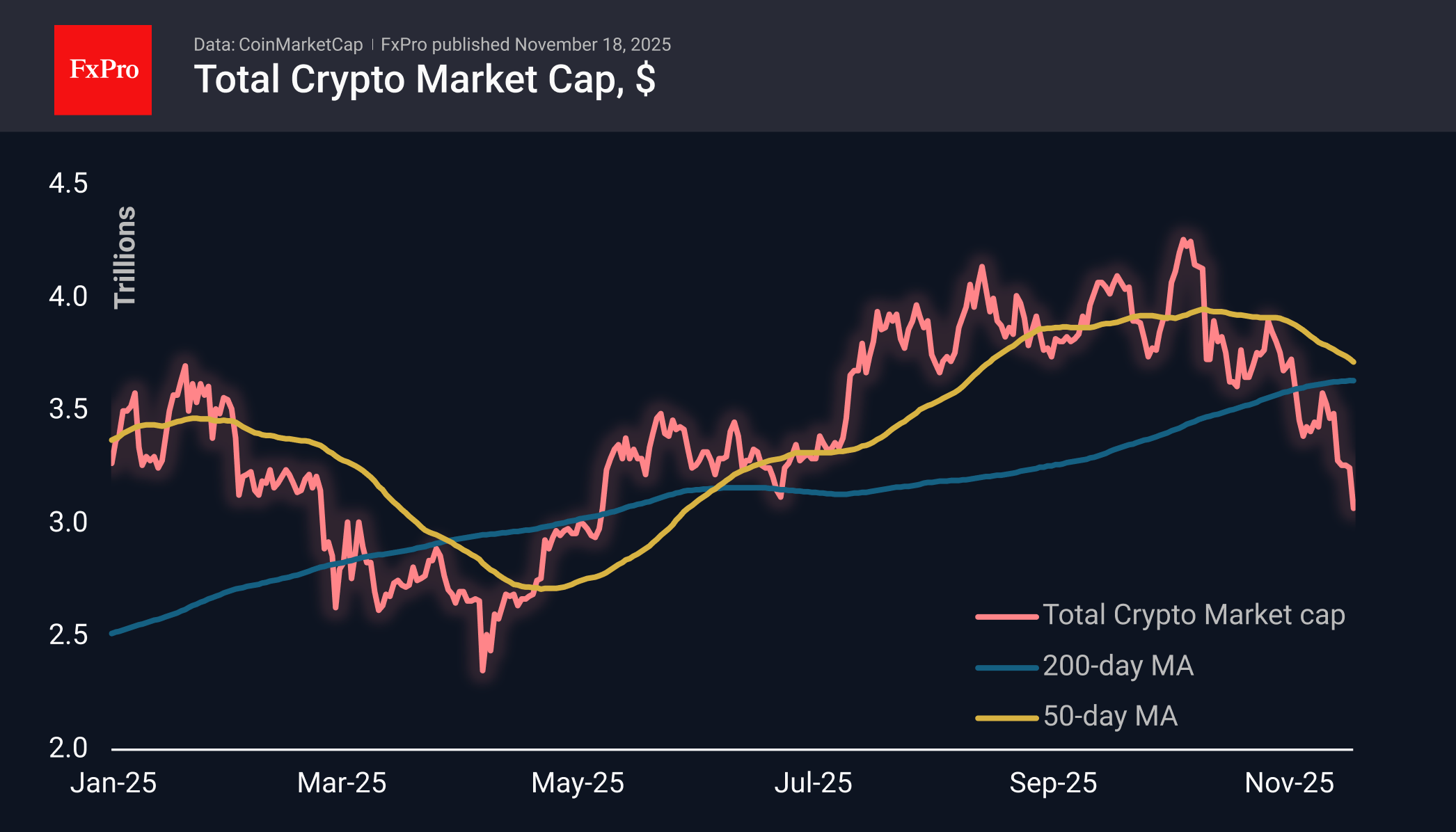

The crypto market is experiencing a sharp decline, losing another 4% over the past 24 hours and falling back to $3.07 trillion, its lowest level since early May. The decline is accelerating relative to the trend observed since 10 October. At this stage, the market is being dragged down by major coins — Bitcoin, Ethereum, XRP — which are losing more than 5%, while some altcoins remain in the shadows. It is unlikely that this should be considered a sign of strength for coins such as Monero (+2.7%), Tron (-1.8%) or Bitcoin Cash (-2.4%). It would be more accurate to say that the bears have not yet reached them.

Bitcoin fell below $90K, trading at its lowest levels since the end of April. As expected, the dip below the 50-week moving average at the end of last week triggered sellers, confirming the breakdown of the bullish trend that had lasted for the previous two years. Now, the working scenario appears to be a chance for BTC to dip to its 200-week moving average. In 2022, this path took 9 weeks and over 30 weeks to form the bottom.

Ethereum fell below $3,000, following Bitcoin, which rolled back below its 50-week moving average. In this case, the 200-week average (approximately $2,300) will deter sellers, and we are considering a decline to $1,700 as a working pessimistic scenario.

News Background

According to CoinShares, global investment in crypto funds declined by $2.036 billion last week, marking the third consecutive week of outflows. Investments in Bitcoin fell by $1.378 billion, in Ethereum by $689 million, in XRP by $16 million, and in Solana by $8 million. Investments in Sui rose by $6 million, in Litecoin by $3 million, and in ETFs with multiple crypto assets by $31 million.

The fall of Bitcoin from its record highs in October was triggered by the capitulation of short-term holders, rather than the distribution of coins by long-term investors, according to XWIN Research.

Ethereum is entering a Supercycle phase like the one that brought Bitcoin a hundredfold increase since 2017, said BitMine CEO Tom Lee. In his opinion, the market decline is attributed to issues with several large market makers attempting to provoke liquidations in Bitcoin.

The inflow of stablecoins to Binance reached $9 billion in 30 days. The indicator is close to historical peaks, which previously preceded strong market movements, notes CryptoOnchain analyst. In his opinion, capital in standby mode can quickly change the market dynamics in favour of the ‘bulls’.

Strategy’s business model is entirely dependent on funds buying its shares and is built on ‘fraud,’ said Peter Schiff, a well-known cryptocurrency critic and gold advocate. Since July, Strategy’s shares have fallen by more than 50%, and recently, its capitalisation has fallen below the value of its assets.

The FxPro Analyst Team