Market picture

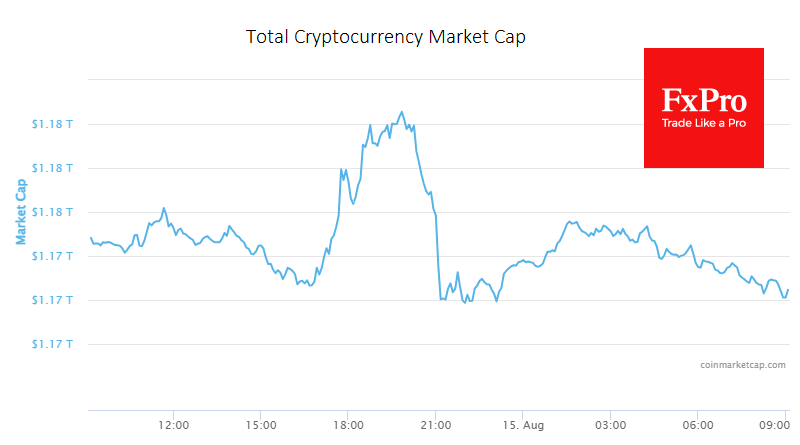

The crypto market cap has slightly declined 0.23% to $1.170 trillion in the last 24 hours. The market failed to break above the $1.18 trillion resistance level and entered a bearish phase in the early hours of Tuesday. This contrasts with the performance of the Nasdaq, which rallied on Monday and continued to rise on Tuesday.

Bitcoin followed the Nasdaq’s lead on Monday but faced strong resistance near $29.6K and fell back to $29.2K. Meanwhile, the stocks have maintained their momentum and gained more ground on Tuesday. This divergence suggests that either the cryptocurrency market is not reflecting the true demand for risk assets or that the stock market is due for a correction soon. Alternatively, it could indicate that crypto is losing its appeal as stocks benefit from investor confidence in the corporate sector.

The $29.4K level remains a centre of gravity for BTCUSD for the last six days. Despite the intraday fluctuations, the daily candles close near their opening levels, indicating a lack of direction and conviction. This usually precedes a sharp move and for now, we see more downside risk, with a potential drop to $28K in the near term.

News background

CoinShares reported that crypto funds saw an inflow of $29 million last week after three weeks of outflows. Bitcoin funds attracted $27 million, Ethereum funds $2.5 million, while funds that allow shorting Bitcoin saw an outflow of $3 million.

Glassnode compared the current situation with the hangover after bear markets and predicted a lasting period of low volatility.

PayPal announced that it will offer a service for storing cryptocurrencies following its stablecoin launch. However, not all PayPal users can access this service, and the company will evaluate each user individually.

Former US President Donald Trump disclosed ownership of $250-500K in digital assets that can be linked to NFT token collections issued on his behalf on the Ethereum network.

The FxPro Analyst Team